Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

As Bitcoin enters a pivotal week, market participants are closely monitoring several key indicators and events that could determine its near-term trajectory. Renowned crypto analyst Ted (@tedtalksmacro) has provided an in-depth analysis, highlighting the critical factors at play.

Weekly Bitcoin Preview

Ted’s analysis begins by contextualizing the broader macroeconomic environment. Last week’s US Consumer Price Index (CPI) and Producer Price Index (PPI) data were optimistic for risk assets, highlighting a continued disinflationary trend. “Both CPI and PPI data were optimistic for risk assets, with each showing that the disinflationary trend remains,” Ted noted. However, he cautioned that the Federal Reserve’s communication suggested that the market should not be overly enthusiastic about imminent rate cuts.

The focal point for this week is the Federal Open Market Committee (FOMC) meeting and its revised dot plot. In March, the dot plot indicated potential rate cuts of 2-3 times in 2024. However, the June dot plot revision suggests a more conservative outlook, indicating only 1-2 cuts. Ted explained, “The March dot plot indicated cutting rates 2-3 times in 2024, but June’s dot plot suggests only 1-2 cuts should be expected.”

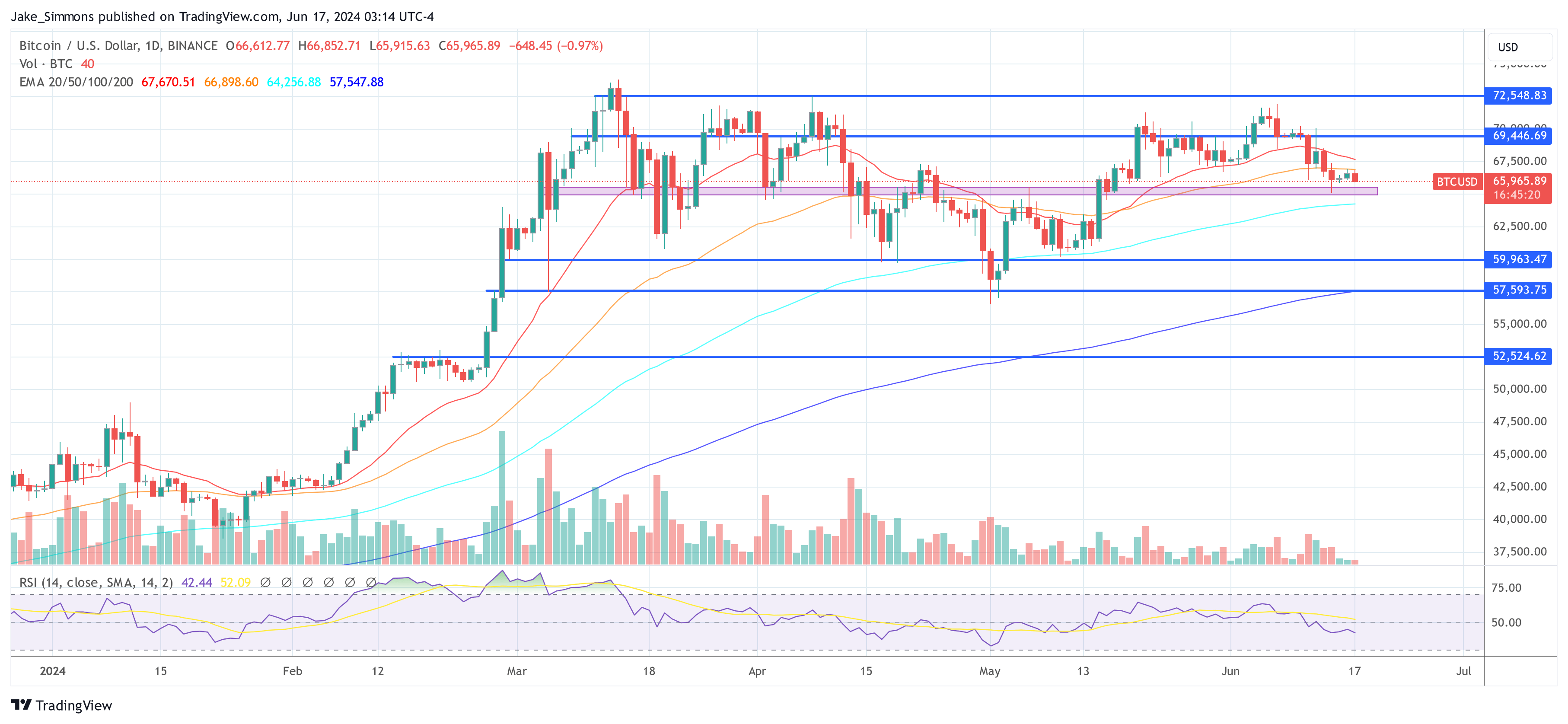

This alignment between the Fed’s projections and market expectations likely provides the central bank with greater flexibility in future communications about interest rates. For Bitcoin, maintaining the $66,000 support level is crucial.

Ted emphasized the importance of this threshold, stating, “It’s critical that Bitcoin maintains its support at $66,000. If broken, sellers could take a stronghold on the market and force quick liquidations out of the bulls.” This support level is seen as a critical threshold, with potential implications for broader market sentiment.

The implied weekly ranges for Bitcoin and Ethereum reflect the cautious optimism among traders. Bitcoin is expected to trade between $65,100 and $74,100, while Ethereum is projected to fluctuate between $3,388 and $4,025. Ted highlighted, “This week is crucial for maintaining BTC’s (and by extension, the broader crypto market’s) short-term trend.”

Ted also pointed out the performance of US tech stocks, particularly the NASDAQ, which has recently hit new all-time highs. “US tech stocks are certainly feeling the disinflationary vibes, with the NASDAQ breaking out to new all-time highs in anticipation of easier central bank policy to come,” he noted. This disconnect shows that something could be cooking for Bitcoin.

Ethereum’s performance relative to Bitcoin is another area of focus. Ted suggested that Ethereum could begin to “play catch up versus Bitcoin,” particularly with the anticipated launch of spot Ethereum ETFs on Wall Street. This potential for Ethereum to close the performance gap with Bitcoin is an important dynamic to monitor in the coming days.

Additionally, rate decisions from the Swiss National Bank (SNB) and the Reserve Bank of Australia (RBA) are on the radar. While no rate cuts are expected from these central banks, their decisions will be scrutinized for any indications of future monetary policy shifts. Ted mentioned, “It’s not expected that the Australian or Swiss Central Banks cut rates at this week’s meeting, but rather remain on hold.”

ETF flows, which slowed last week due to market jitters ahead of key macro events, are also expected to play a critical role. Ted noted, “Last week saw slowing ETF flows on Wall Street for Bitcoin. Likely owed to jitters ahead of key macro events, it will be key for BTC strength that flows return in the week ahead.” Strong ETF flows are essential for maintaining liquidity and supporting Bitcoin’s price.

In conclusion, this week is set to be pivotal for Bitcoin and the broader crypto market. The interplay of disinflation trends, Federal Reserve communications, key support levels, and external economic factors will shape the market’s direction. Ted concluded, “The data is clearly pointing towards a shift to more accommodative monetary policy—and potentially sooner rather than later. This reinforces my view that dips are buying opportunities for risk assets like cryptocurrencies and stocks.”

At press time, BTC traded at $65,965.