Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

In his latest market analysis titled “Sugar High”, BitMEX founder Arthur Hayes lists four reasons to be bullish on Bitcoin and the broader crypto market in the final quarter of 2024.

Hayes opens his analysis with a metaphorical comparison of his skiing diet to the fiscal approaches of major central banks. He likens quick energy snacks to short-term monetary policy adjustments, particularly the interest rate cuts by the US Federal Reserve, the Bank of England, and the European Central Bank. These cuts, he argues, are like “sugar highs”—they boost asset prices temporarily but must be balanced with more sustainable financial policies, akin to “real food” in his analogy.

This pivotal monetary policy shift after Federal Reserve Chairman Jerome Powell’s announcement at the Jackson Hole symposium, triggered a positive reaction in the market, aligning with Hayes’s prediction. He suggests that the anticipation of lower rates makes assets priced in fiat currencies with fixed supplies, such as Bitcoin, more attractive, hence boosting their value. He explains, “Investors believe that if money is cheaper, assets priced in fiat dollars of fixed supply should rise. I agree.”

However, Hayes cautions about the potential risks of a yen carry trade unwind, which could disrupt the markets. He explains that the anticipated future rate cuts by the Fed, BOE, and ECB could reduce the interest rate differential between these currencies and the yen, posing a risk of destabilizing financial markets.

Hayes argues that unless real economic measures, akin to his “real food” during ski touring, are taken by central banks—specifically expanding their balance sheets and engaging in quantitative easing—there could be negative repercussions for the market. “If the dollar-yen smashes through 140 on the downside in short order, I don’t believe they will hesitate to provide the “real food” that the filthy fiat financial markets require to exist,” he adds.

To further solidify his argument, Hayes references the US economy’s resilience. He notes that the US has only experienced two quarters of negative real GDP growth since the onset of the COVID-19 pandemic, which he argues is not indicative of an economy that requires further rate cuts. “Even the most recent estimation of 3Q2024 real GDP is a solid +2.0%. Again, this is not an economy suffering from overly restrictive interest rates,” Hayes argues.

4 Reasons To Be Bullish On Bitcoin In Q4

This assertion challenges the Fed’s current trajectory towards lowering rates, suggesting that it might be more politically motivated rather than based on economic necessity. In light of this, Hayes presents four key reasons to bullish on Bitcoin and the broader crypto market in Q4.

1. Global Central Bank Policies: Hayes highlights the current trend of major central banks, which are cutting rates to stimulate their economies despite ongoing inflation and growth. “Central banks globally, now led by the Fed, are reducing the price of money. The Fed is cutting rates while inflation is above their target, and the US economy continues to grow. The BOE and ECB will likely continue cutting rates at their upcoming meetings,” Hayes writes.

2. Increased Dollar Liquidity: The US Treasury, under Secretary Janet Yellen, is set to inject significant liquidity into the financial markets through the issuance of $271 billion in Treasury bills and an additional $30 billion in buybacks. This increase in dollar liquidity, totaling around $301 billion by year-end, is expected to keep financial markets buoyant and could lead to increased flows into Bitcoin and crypto as investors seek higher returns.

3. Strategic Treasury General Account Usage: Approximately $740 billion remains in the US Treasury General Account (TGA), which Hayes suggests will be strategically deployed to support market conditions favorable for the current administration. This substantial financial maneuvering capability could further enhance market liquidity, indirectly benefiting assets like Bitcoin that thrive in environments of high liquidity.

4. Bank Of Japan’s Cautious Approach To Interest Rates: The BOJ’s recent apprehensive stance towards raising interest rates, particularly after observing the impact of a minor rate hike on July 31, 2024, signals a cautious approach that will consider market reactions closely. This cautiousness, intended to avoid destabilizing markets, suggests a global environment where central banks might prioritize market stability over tightening, which again bodes well for Bitcoin and crypto.

Hayes concludes that the combination of these factors creates a fertile ground for Bitcoin’s growth. As central banks globally lean towards policies that increase liquidity and reduce the attractiveness of holding fiat currencies, Bitcoin stands out as a finite supply asset that could potentially skyrocket in value.

“Some fear that the Fed cutting rates is a leading indicator of a US and, by extension, developed market recession. That might be true, but […] they will ramp up the money printer and dramatically increase the money supply. That leads to inflation, which could be bad for certain types of businesses. But for assets in finite supply like Bitcoin, it will provide a trip at lightspeed 2 Da Moon! Hayes states.

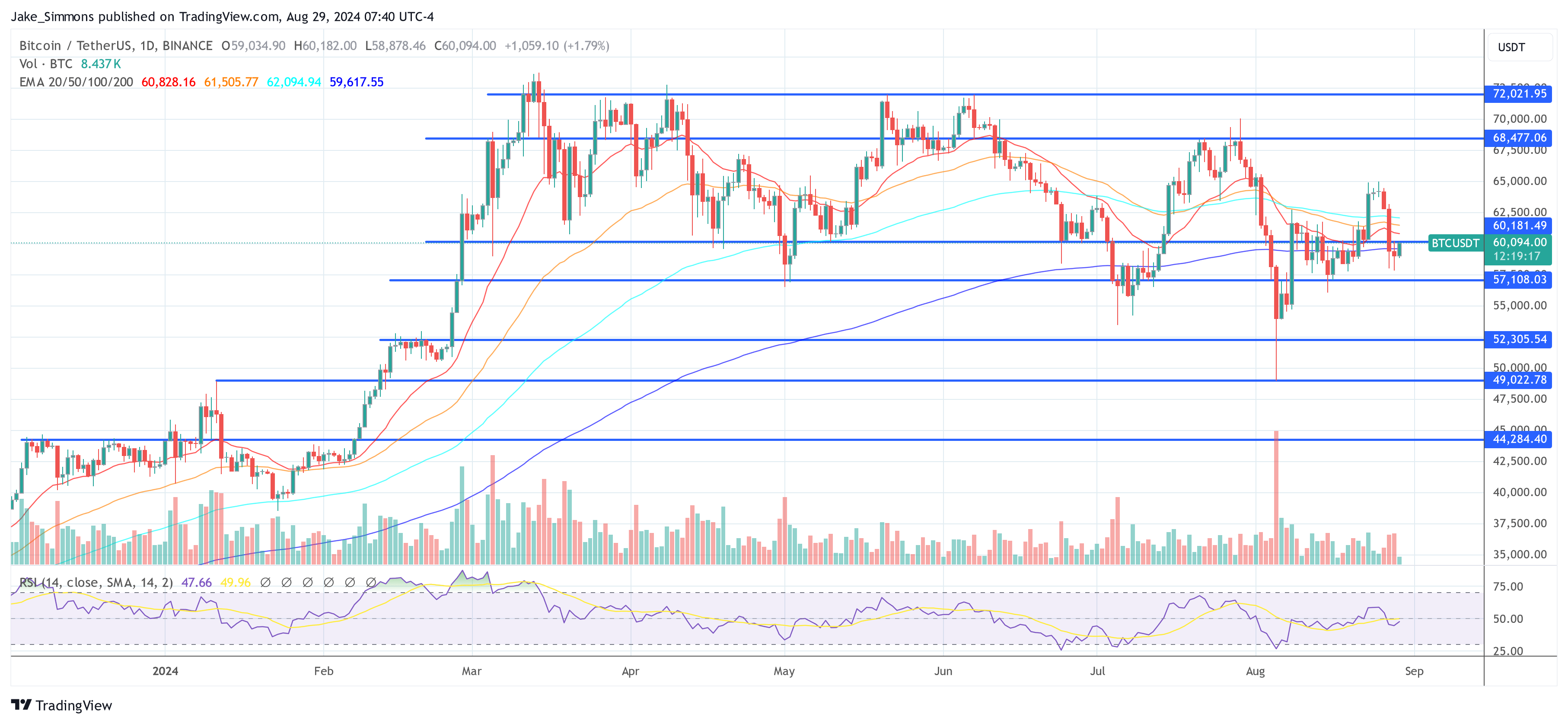

At press time, BTC traded at $60,094.