Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

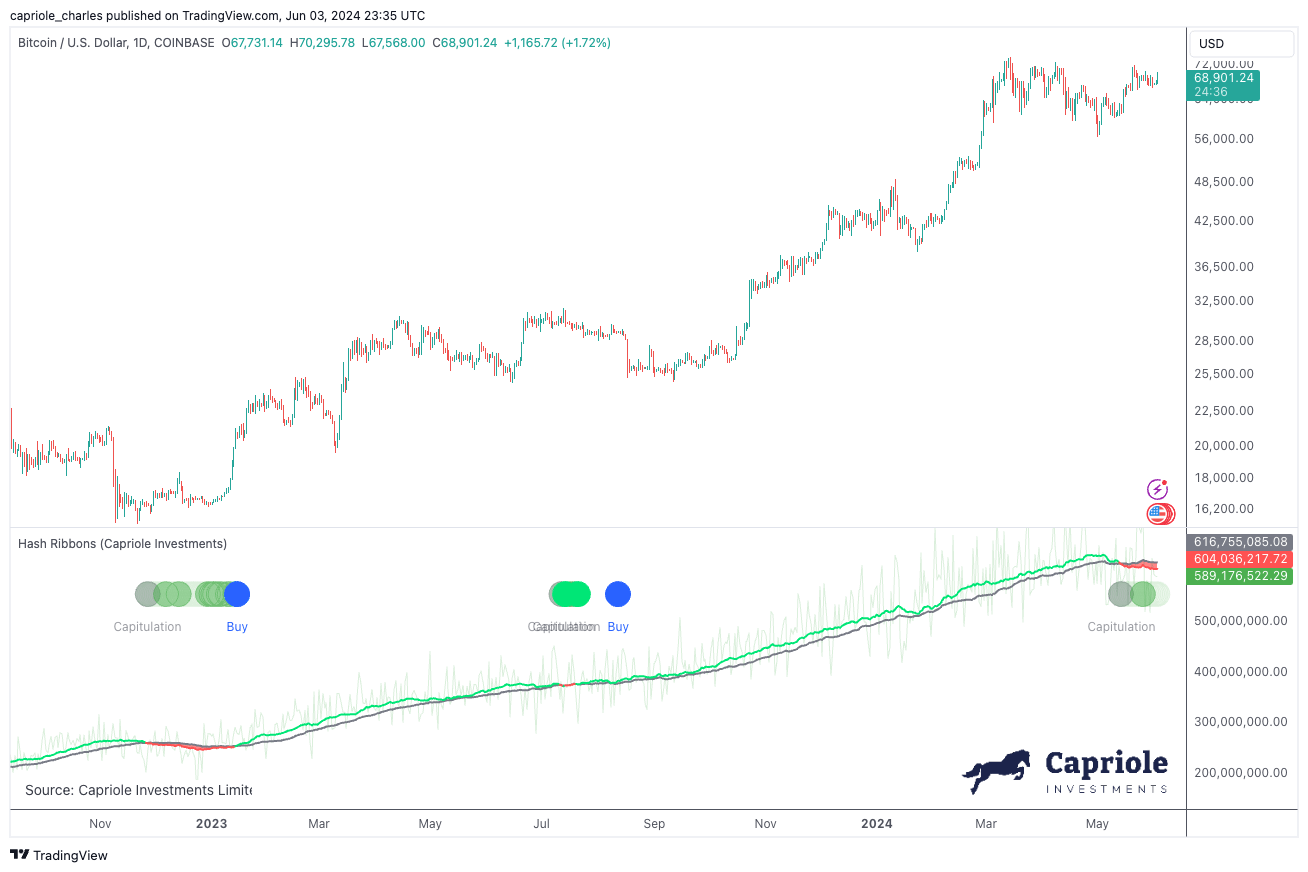

In his latest dispatch, Charles Edwards, CEO of the Bitcoin and digital asset hedge fund Capriole, has flagged a significant market indicator in the latest edition of the firm’s newsletter, Update #51. Edwards points to the activation of the “Hash Ribbons” buy signal, a notable event that has historically indicated prime buying opportunities for Bitcoin.

Bitcoin Hash Ribbons Flash Buy Signal

The Hash Ribbons indicator, first introduced in 2019, utilizes mining data to predict long-term buying opportunities based on miners’ economic pressures. The signal arises from the convergence of short-term and long-term moving averages of Bitcoin’s hash rate, specifically when the 30-day moving average falls below the 60-day. According to Edwards, this event has “in the vast majority of cases synced with broader Bitcoin market weakness, price volatility and significantly long-term value opportunities.”

The current Miner Capitulation, as highlighted by Edwards, began two weeks ago and coincides with post-halving adjustments in the mining sector. This period often leads to the shuttering of operations and even bankruptcies among less efficient miners. Edwards notes, “Just as we are seeing today, these mining rigs will typically then be phased out over several weeks following the Halving resulting in falling hash rates.”

Despite the historical profitability of miners, especially with increased block fees from new applications such as Ordinals and Runes, Edwards suggests that the market should not overlook the current opportunity signaled by the latest Miner Capitulation. “While this capitulation is occurring when miners have broadly been profitable, we would be remiss not to note this rare opportunity,” stated Edwards.

The Hash Ribbons have not been without their critics, with each occurrence stirring debate about the current relevance and accuracy of the signal. Edwards addressed these criticisms by referencing the previous year’s signal, which correlated with Bitcoin trading in the $20,000 range, reinforcing the indicator’s predictive strength. “Every occurrence brings some debate about their relevance today, or why the current signal perhaps doesn’t count,” Edwards explained.

Edwards recommends that the safest approach to leveraging the Hash Ribbons is by waiting for confirmation through renewed hash rate growth and a positive price trend. He concludes, “The safest (lowest volatility opportunity) to allocate to the Hash Ribbons strategy is on confirmation of the Hash Ribbon Buy which is triggered by renewed Hash Rate growth (30DMA>60DMA) and a positive price trend (as defined by the 10DMA>20DMA of price).”

Broader Market Context

Transitioning from the technical to the contextual, Edwards discusses the changing regulatory landscape that has recently become more favorable to cryptocurrencies. The SEC’s approval of an Ethereum ETF, categorizing ETH as a commodity, marks a significant shift in the regulatory approach towards cryptocurrencies and reflects growing institutional acceptance.

“The reclassification of Ethereum and the approval of its ETF represent a pivotal shift in governmental stance on cryptocurrencies,” Edwards notes. “This could lead to increased institutional involvement and potentially more stability in the crypto markets.”

Furthermore, Edwards points to macroeconomic factors that could influence Bitcoin’s value. The expansion of the M2 money supply and the Federal Reserve’s stance on interest rates are designed to stimulate economic activity. However, Edwards warns of the potential long-term consequences of these policies, such as inflation, which could enhance Bitcoin’s appeal as a hedge against monetary devaluation.

“Bitcoin was conceptualized as an alternative to traditional financial systems in times of economic stress,” Edwards remarks. “The current economic policies reinforce the fundamental reasons for Bitcoin’s existence and could lead to increased adoption.”

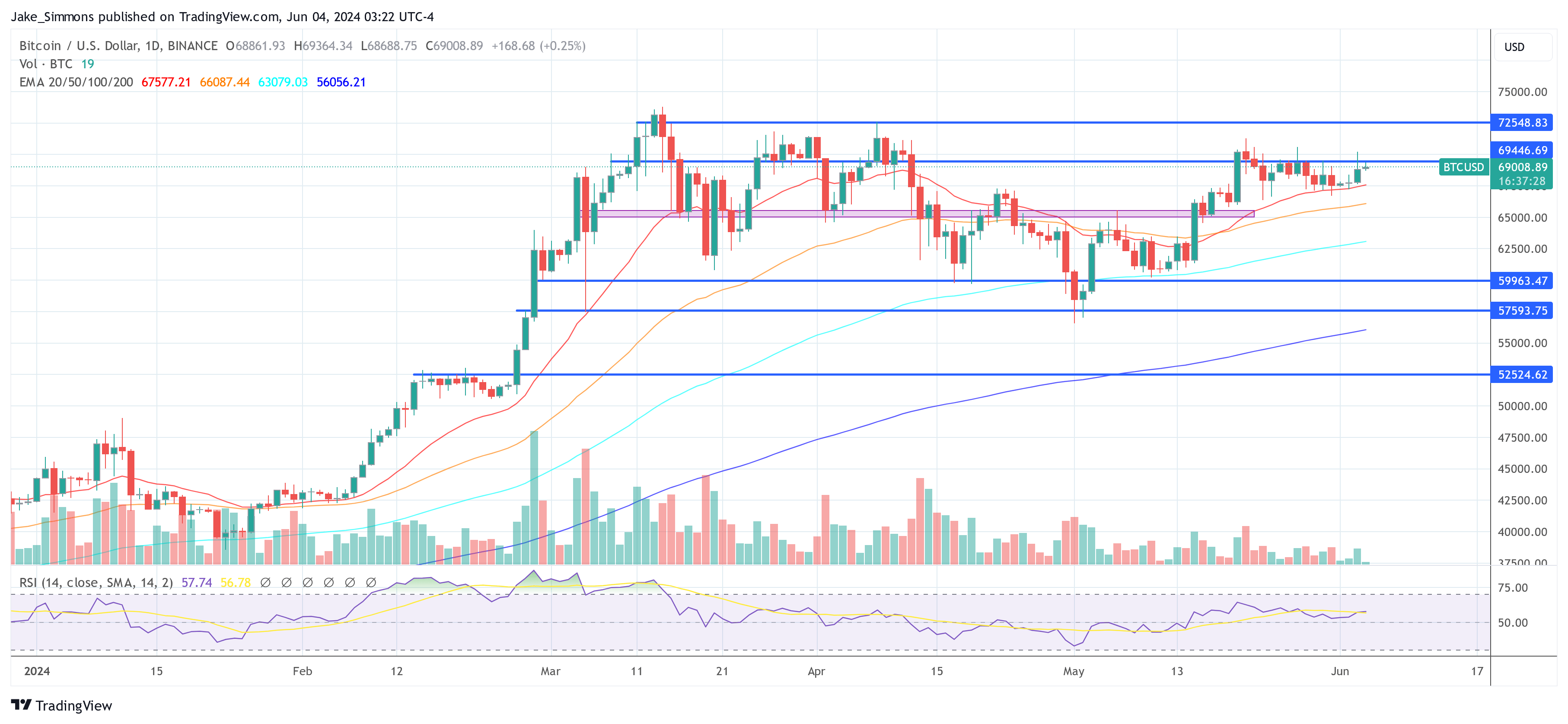

On the technical front, Edwards provides an analysis of Bitcoin’s price movements, highlighting the recent breakout and consolidation above critical resistance levels. He sets a conditional mid-term price target of $100,000, contingent upon the market sustaining its current momentum and the monthly close remaining above a critical threshold of $58,000.

At press time, BTC traded at $69,008.