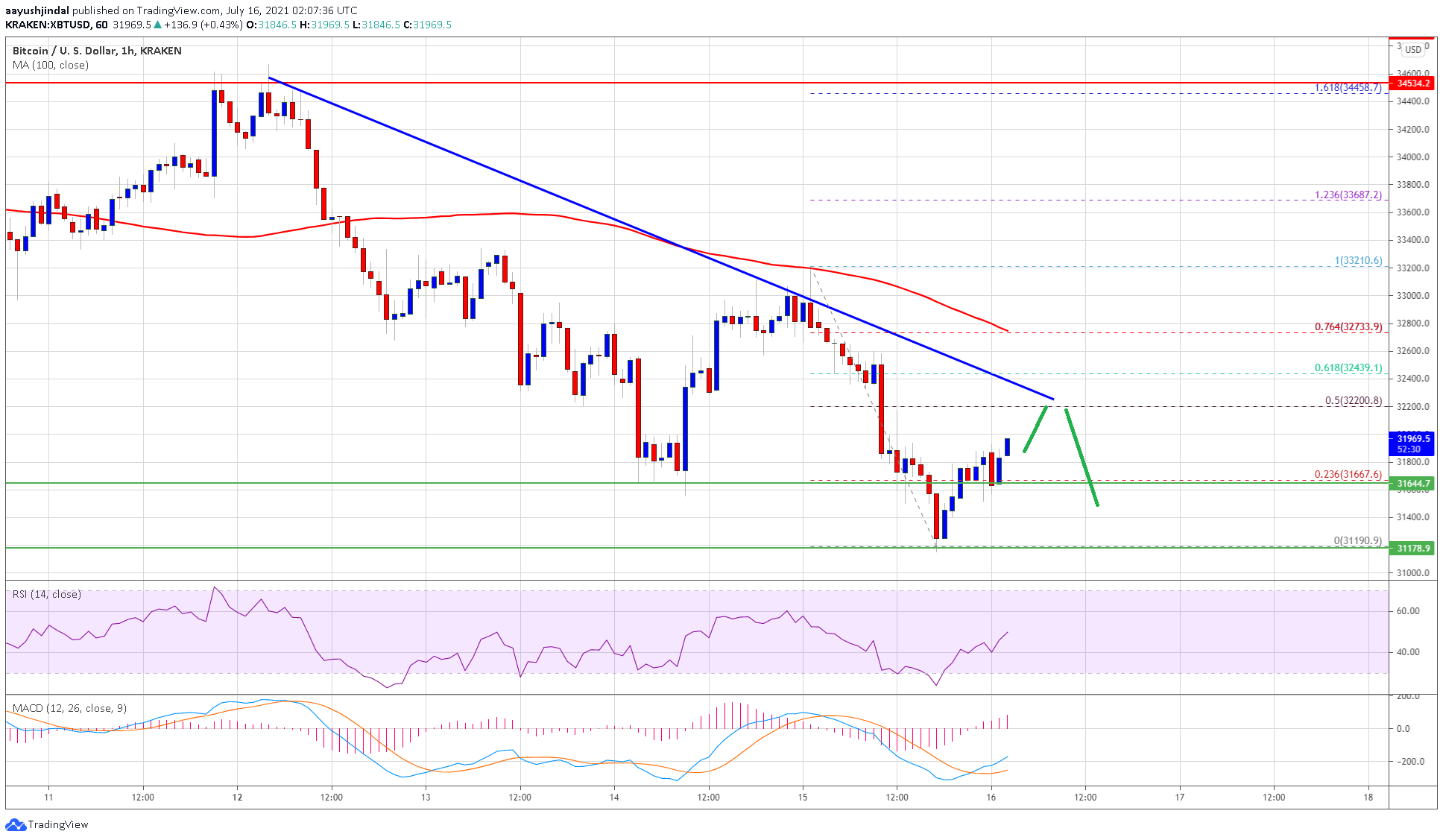

Bitcoin price extended its decline below $31,500 before recovering higher against the US Dollar. BTC is likely to face resistance near $32,200 and it might continue to move down.

- Bitcoin remains in a bearish zone and it recently traded towards the $31,000 level.

- The price is now trading well below $33,000 and the 100 hourly simple moving average.

- There is a major bearish trend line forming with resistance near $32,250 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair must settle above $32,250 and the 100 hourly SMA to start a decent increase in the near term.

Bitcoin Price Remains In Downtrend

After a minor upside correction, bitcoin price failed near $33,000. As a result, BTC started a fresh decline below the $32,000 support level. It even broke the $31,550 swing low and settled well below the 100 hourly simple moving average.

It traded as low as $31,190 before it started an upside correction. There was a break above the $31,500 and $31,600 resistance levels. Bitcoin climbed above the 23.6% Fib retracement level of the recent decline from the $33,210 swing high to $31,190 low.

An immediate resistance on the upside is near the $32,000 level. The first major resistance is near the $32,200 level. There is also a major bearish trend line forming with resistance near $32,250 on the hourly chart of the BTC/USD pair.

The trend line is close to the 50% Fib retracement level of the recent decline from the $33,210 swing high to $31,190 low. A close above the trend line resistance could push the price towards the $33,000 resistance and the 100 hourly SMA.

Source: BTCUSD on TradingView.com

To start a decent increase, the price must settle above the $33,000 level and the 100 hourly SMA. The next major resistance sits near $33,500.

More Losses in BTC?

If bitcoin fails to recover above the $32,200 and $33,000 resistance levels, there is a risk of more losses. An initial support on the downside is near the $31,500 level.

The first major support is now near the $31,200 zone. A close below the $31,200 level could spark a steady decline in the near term. In the stated case, the price is likely to test the $30,000 support level.

Technical indicators:

Hourly MACD – The MACD is slowly gaining pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now just above the 50 level.

Major Support Levels – $31,500, followed by $31,200.

Major Resistance Levels – $32,200, $32,500 and $33,000.