Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

The world’s most loved cryptocurrency Bitcoin has registered the highest daily closing of 2015 at $417.89, while less prominent cryptocurrency Dogecoin has crashed to a fresh 2015 low of 22.7 satoshis.

After spending considerable time near $400, Bitcoin finally pierced this resistance on news that an Australian man named Craig White could be the real Satoshi Nakamoto. While the claim is yet to be verified, it has certainly attracted strong speculative bullish interest raising hopes that $500 will again be touched. Bitcoin is currently trading at $418.36.

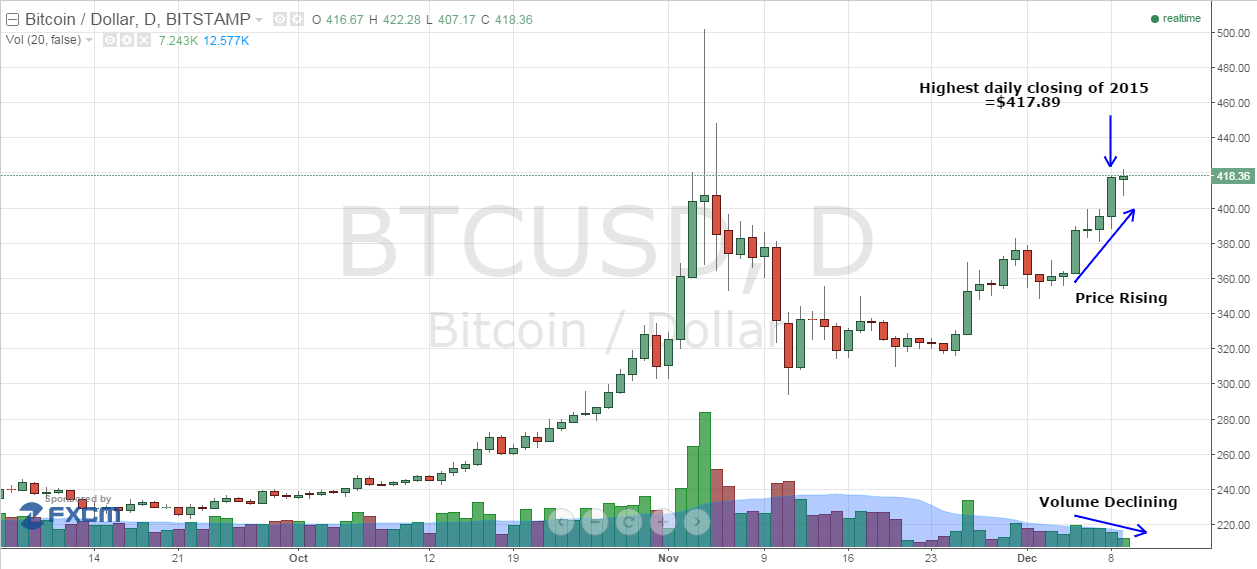

However, market participants should take a look at the technicals behind this price rally. While the price has risen from $360 to $418, the volume has shown a consistent decline (a red flag). See the daily BTC-USD price chart from the Bitstamp exchange.

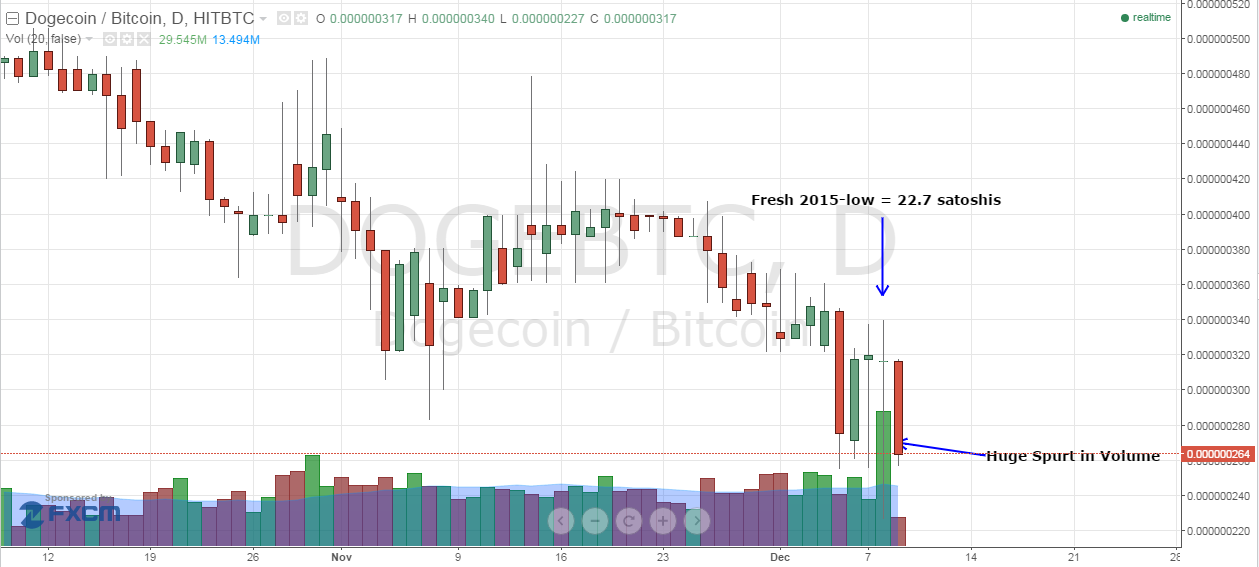

Dogecoin continues to be depressed under the strong bearish bias. While earlier it was roughly down 50% for the year-to-date, the losses are now much worse, making it a forgettable year for Dogecoin investors. And as can be seen from the daily DOGE/BTC chart from HitBTC below, the 2015 low was hit on strong volume, suggesting unrelenting selling pressure. Dogecoin is currently trading at 26.4 satoshis.

Conclusion

The decline in DOGE/BTC can also be understood in a simpler way: since Bitcoin is the base currency in the pair, an advancing base currency would lead to a declining value of the pair as the lead currency fails to attract investors at the same rate. Bitcoin is currently in the strong clutches of the bulls, and is hence causing the rout in Dogecoin.

Market participants should also note that a declining volume on rising price is an indication that even lesser bulls are leading the rally: a cause of concern. Similarly, volume readings in Dogecoin should also be considered to find any signs of reversal.

As far as volume is concerned, chinese exchanges have to be taken into account, in contrary, which has an increasing volume pattern. Even if artificial volume is involved, I still believe CNY exchanges have much bigger volume than USD ones.