Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

We’re heading towards the close of another European day in the bitcoin space, and things have been pretty uninspiring during the day’s session. Having remained relatively flat throughout the evening last night, we hoped we’d see some volatility throughout Europe and the US morning for a couple of reasons. The first, that we had an as yet incomplete trade running from yesterday evening – a long trade towards 426 that we entered on a break of in term resistance. The second, that we wanted to run a consecutive trade in an attempt to extend and double up on a target before we head into the second half of the week.

Unfortunately, we didn’t see the volatility we’d hoped for, and we remain net long on the Tuesday evening position. With this in mind, we’re going to tighten things right up for this evening’s session, in an attempt to pull a scalp profit from the markets on a narrower timeframe.

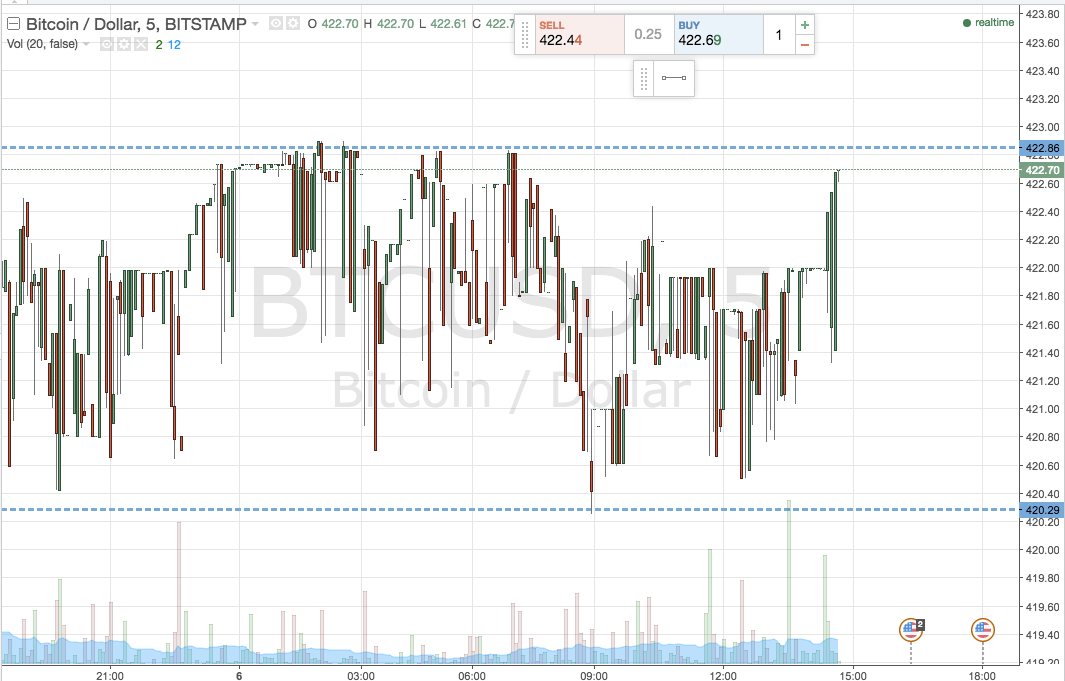

The chart below shows the framework with which we are working this evening and going forward into tonight’s session in Asia. It’s a five minute candlestick chart, with something like the last twenty four hours’ worth of action in the bitcoin price displayed.

As the chart shows, we are looking at a real narrow range tonight. It’s defined by in term support at 420.29, and in term resistance at 422.86.

We’re currently trading just shy of in term resistance, so let’s look at the upside first. A close above in term resistance would signal a long entry towards an immediate upside target of 425 flat. A tight stop is necessary to protect our risk, and somewhere in the region of 421.5 looks good.

To the downside, a close below support will signal short towards 417 flat, with a stop at 421.5 once again defining our risk on the position.

Happy trading!

Charts courtesy of Trading View