Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

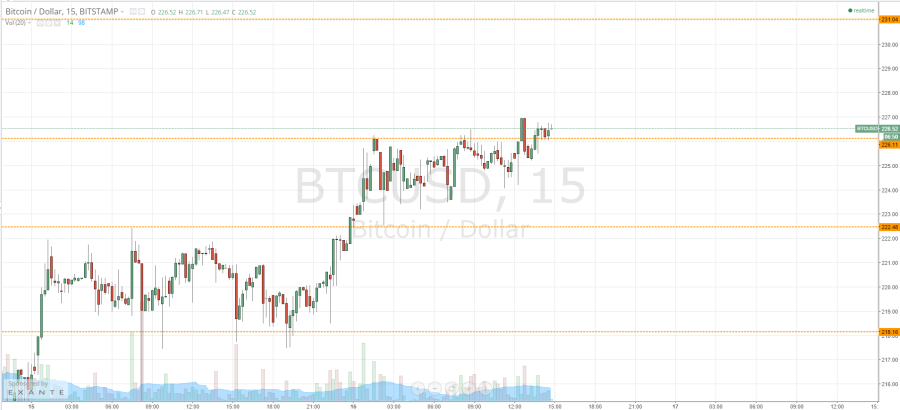

Early this morning we published our twice-daily bitcoin price watch piece, and highlighted the levels that we would be keeping an eye on as action matured throughout the Thursday European session. One of the things that we noted was the apparent lack of volatility we have seen over the last few days, and the tight range within which the bitcoin price had held this week. Now, as action during the European session has matured and is drawing to a close, what are we keeping an eye on? Further, what can price action during the US afternoon tells about what we may see as we head into the weekend? Take a quick look at the chart.

As you can see, the thesis of our analysis piece this morning remains in place, with bitcoin moving very little throughout today’s session. The only thing really worth noting is that we had a temporary break out (signalling a long entry according to our strategy) before a return to range and, once again, a weak break out towards the levels at which we now trade.

We are in long at this breakout, with a stop at 225 flat, and a medium-term target of 231.04. If we do see a return to the range action confined within in term support at 222.48 and resistance at 226 .11, we may well be taken out of the trade for a small loss as per our risk parameters. In such a scenario, we would look to enter short on a bias reversal, with an initial downside target of 222.48 (in term support) and a stop just ahead of current levels (around 227 flat – perhaps a little higher to avoid us being chopped out).

One thing to bear in mind is that – with such tight action – there is always the possibility of an explosive breakout just round the corner. Keep tight stops to ensure that – in the event of finding yourself on the wrong end of one of these breakouts – you don’t sustain irretrievable losses.

Charts courtesy of Trading View