Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

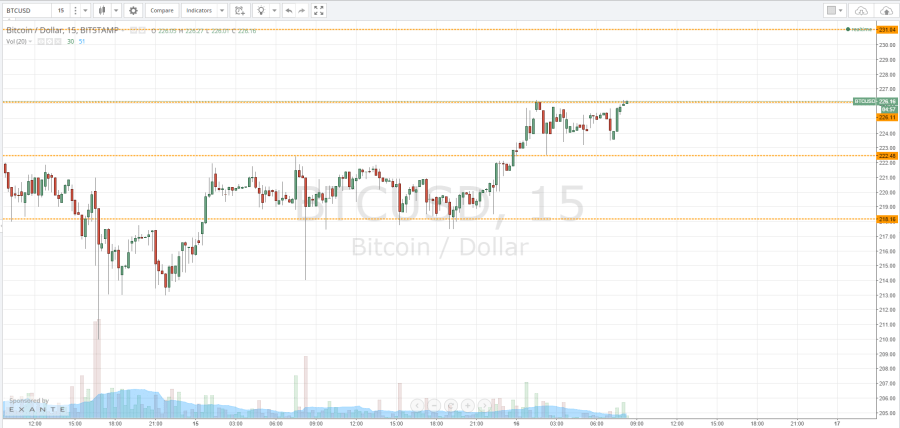

The action we have seen over the last few days in the bitcoin price has primarily consisted of tight, range bound action interjected with the odd breakout, but normally succeeded by a return to the ranges we highlighted in our morning intraday piece. With this in mind, today’s strategy will incorporate our standard range trading practices, but on a much tighter scale than normal. With this said, what happened to the bitcoin price on Wednesday evening and as the US session closed yesterday, and what can we expect from the BTCUSD as we head into a fresh session of trading in the UK? Take a quick look at the chart.

As the chart shows, we are currently trading between in term support at 222.48 and resistance at 226.16, the latter of which is pretty much sitting around current price. These two levels are the ones will be keeping an eye on as the European session kicks off.

Things are looking like we may get a break above in term resistance very shortly, and if we do, we will look for a bullish run towards 231.04 as an initial upside target. In this trade, a tight stop just below 226 will ensure we are taken out of the trade in the event that we do return to trade back in the range outlined on a fundamental interjection.

If we get a bounce from current levels, we will look for a downside entry towards in term support at 222.48, with a stop loss just above 227 flat to keep our risk profile tight. If we can break below 222.48 (in term support), we will look to 218.16 as a secondary downside target, with a stop loss somewhere around 224 flat giving us a nice risk reward profile and ensuring we don’t get caught out on the wrong side of an upside spike.

Charts courtesy of Trading View