The European session is about to close for the day, and the US afternoon is set to take over the lion’s share of the bitcoin price market volume. As ever, the second of our two daily bitcoin price analyses will cover our approach going forward into the US afternoon and beyond into Asia, with a specific focus on how action played out today (in relation to our predefined intraday strategy) and how we can interpret this action as part of this evening’s plan.

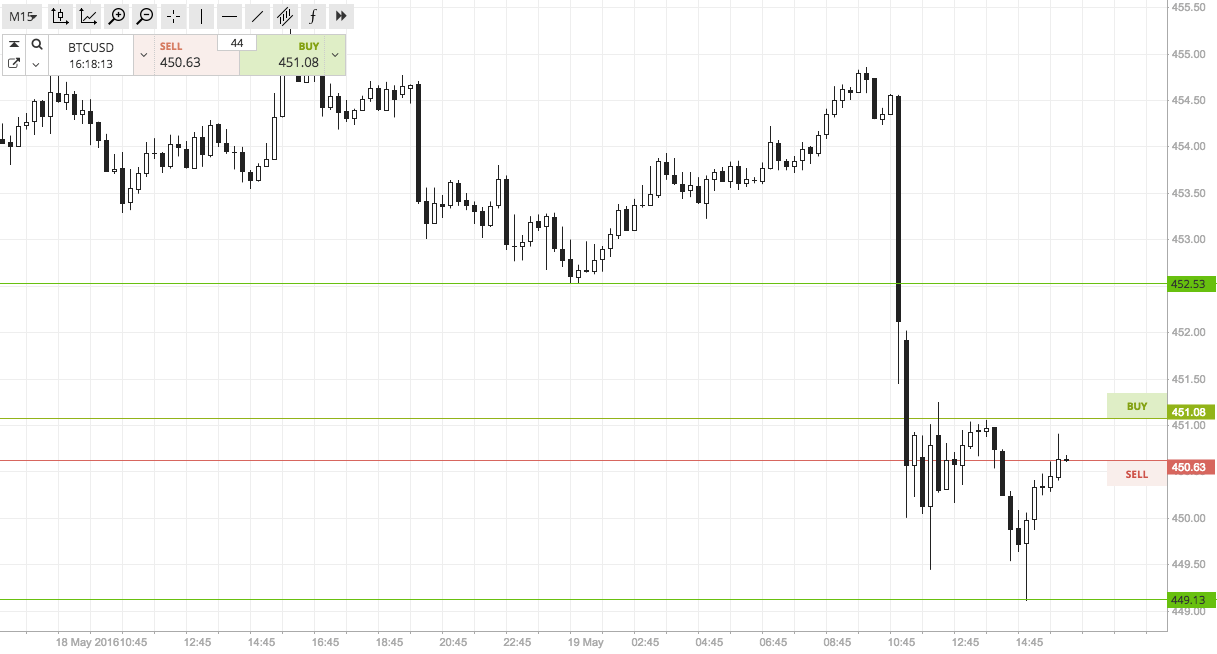

So, with this said, and as we head into the European afternoon close, here is a look at what we are focusing on in the bitcoin price this evening, and a look at how this morning’s action has affected our key levels for this evening. First up, get a quick look at the price chart below. It’s an intraday, fifteen-minute chart that shows the last twenty-four hours worth of action in the bitcoin price. It also has our altered range overlaid, so you can get an idea of the key levels in focus before we proceed.

So, as the chart shows, action throughout today’s session has been relatively muted, and we’ve not really had that much t go on. We got in short according to our breakout strategy pretty much as soon as we published our first analysis, but since then, have traded sideways for a pretty uninspiring day of action.

For this evening, we are going to shift in term support to 449 flat, and have in term resistance at 452.5. It’s too tight for intrarange, so breakout only this evening.

Specifically, long on a close above support, target 456 and stop at 450. Looking short, enter a downside position on a close below support with a target of 445 flat and a stop at 451 to define risk. Simple.

Happy Trading!

Charts courtesy of SimpleFX

Image via NewsBTC