Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

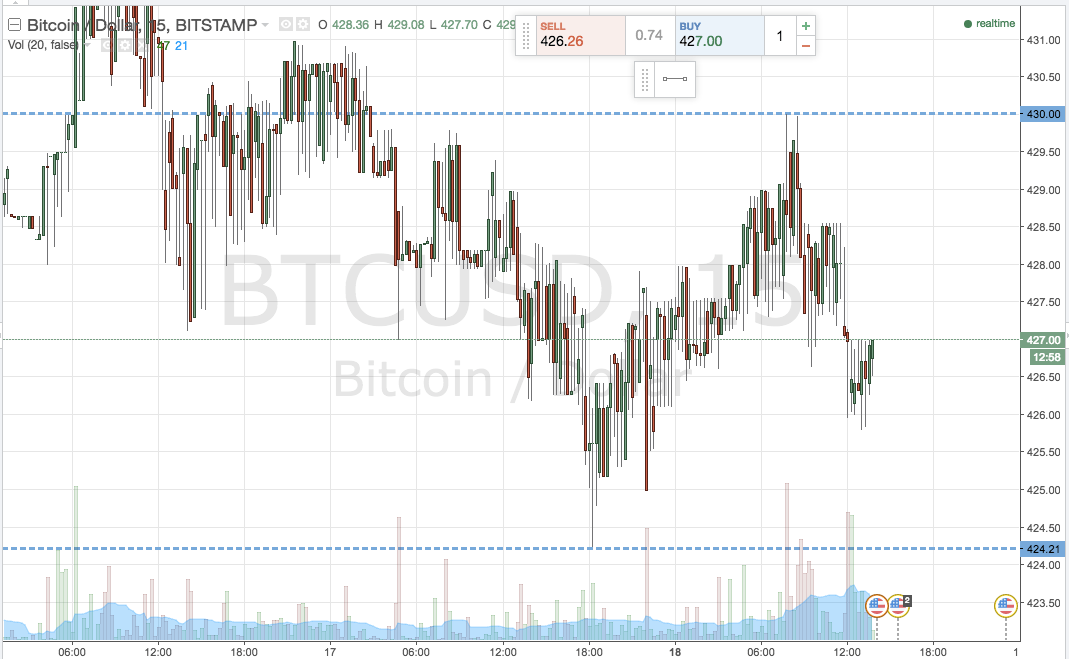

In this morning’s bitcoin price watch piece, we discussed the fact that we are finally able to bring our intrarange strategy in to play, and attempt to draw a profit from action confined within our range. We were working with a circa five dollar range, and coming off the back of a pretty volatile weekend, so the hope was that we’d be able to get in two fold – first, on a bounce from support with a target of resistance to the upside, and second, long on a break of in term resistance towards an upside target of 430 flat.

As it turns out, action throughout the European morning session has been relatively flat, and while we did see some movement, it hasn’t been enough to get us in and out of a position – yet.

We’ve still got the full US afternoon session ahead of us, and as volume picks up, we should see some movement. Again, it might not be enough to get us in on both positions, but we don’t need much to get in on the breakout, so with any luck we’ll see this one realized at a minimum.

So, with this said, what are the levels we are looking at now in the bitcoin price, and do the positions we outlined this morning remain relevant? To get an idea of what we’re looking at, take a quick look at the chart below.

As the chart shows, the range we are focusing on for this afternoon is the same as the one we targeted this morning. In term support sits at 425 flat, while in term resistance comes in at 430 flat.

Same trading rules apply – long on a close above resistance towards 435, and short on the same below support towards 419 flat. Stops just the other side of the entry to define risk.

Charts courtesy of Trading View