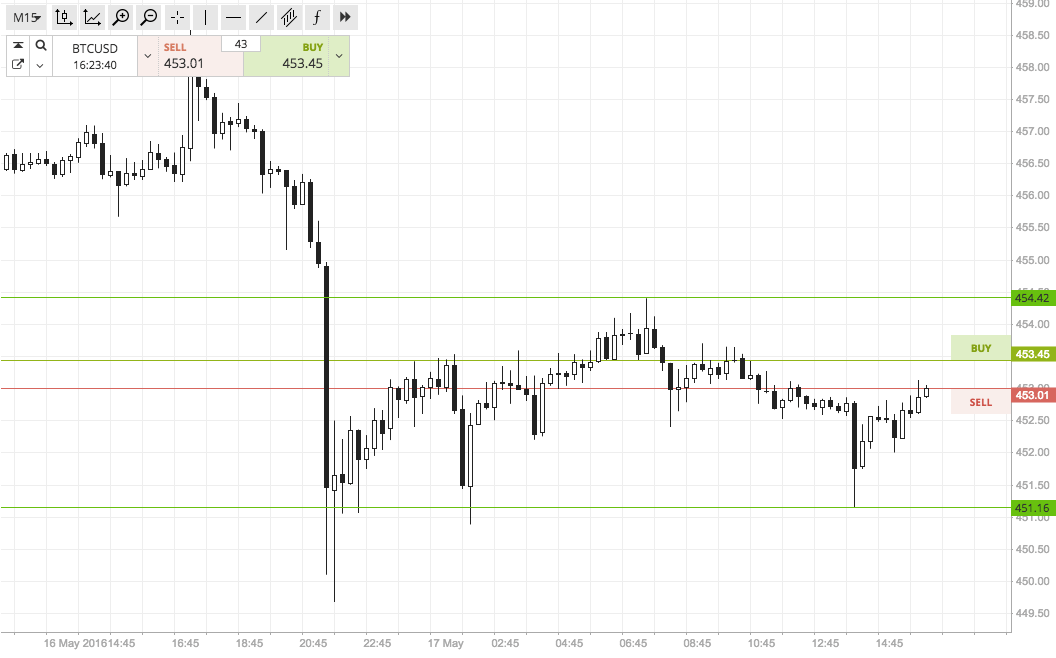

We are approaching the close of the European session in the bitcoin price, and one look at action throughout the day reveals that there has been very little worth trading. We defined a relatively tight range earlier on this morning as a return to our breakout strategy, but price has traded pretty much flat, and well within our range, throughout the entire session. This sort of flat action is very difficult to work with as it is indicative of indecision. Indecision pretty much always translates to false breakouts, which in turn, translate to choppy and unpredictable action. On the bright side, it makes our analysis this evening all that much easier. We don’t really need to do much jumping around, other than perhaps tighten our range a little to increase the chances of a break and – in turn – a sustainable move. So, with this said, and as we head into this evening’s session, what are we looking to trade in the bitcoin price now, and how can we use action today to alter our strategy going forward? Take a quick look at the chart below to get an idea of the answer to these questions.

As the chart shows, we have shifted support to the downside a little, and it now sits at 451. Resistance remains at 454.5 to the upside.

If we see price break through resistance, we will look to enter long towards an initial upside target of 460. A stop loss on this one around 453 (current levels) defines risk on the trade.

Looking short, if price breaks and closes below support, it will signal a relatively conservative trade towards 445. We need a little bit of a tighter stop on this one, and 452 flat looks good.

As an aside, an intrarange approach is probably too risky given the relative narrowness of this evening’s parameters. This might change early tomorrow morning if we are able to widen things out on a sustained movement.

Happy Trading!

Charts courtesy of SimpleFX.

Image via NewsBTC