Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

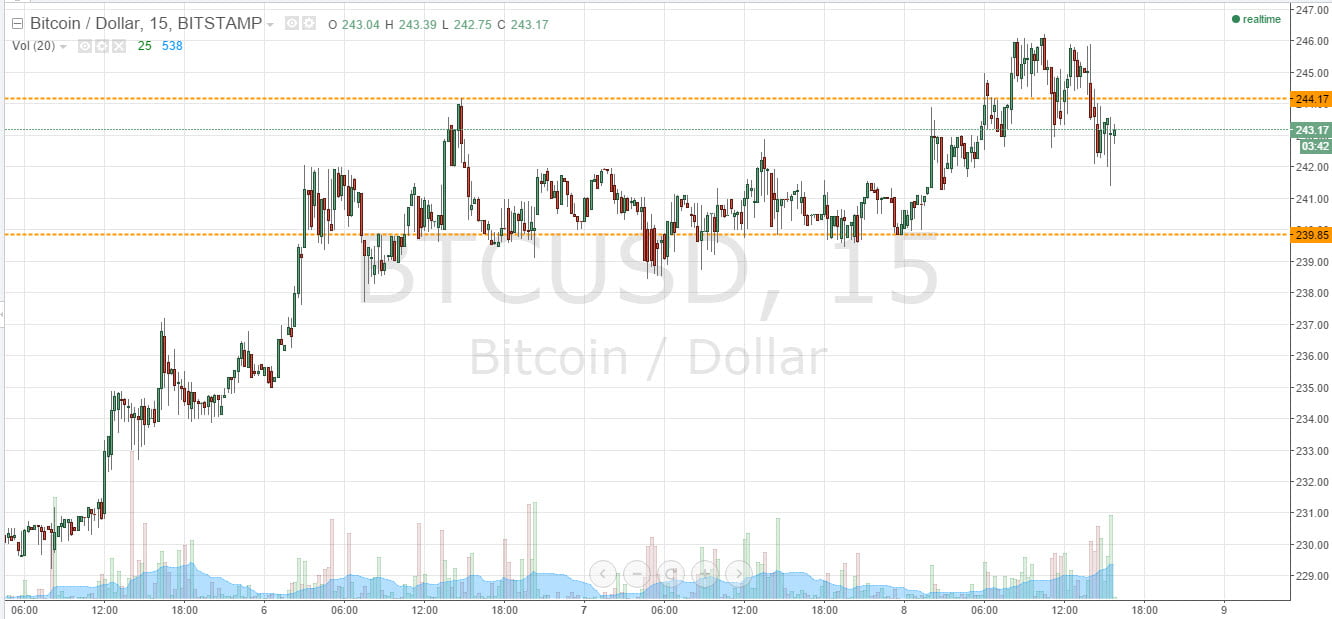

In this morning’s bitcoin price watch piece, we highlighted the levels that we were looking to keep an eye on during the European session today. We hoped that based on the action we had seen throughout the Asian evening session on Monday, we might get a continuation to the upside and be able to enter on a break of in term resistance towards 250 flat. As it happened, we did get the break, but the momentum was unable to carry it through to our target. As a result, we are now looking at the same levels we had slated this morning as the ones to watch this evening. With this said, we are going to alter our strategy slightly in order to accommodate recent action. First up, take a quick look at the chart.

As you can see, action during today’s session saw a break of in term resistance at 244.17, but the break didn’t last long and we quickly returned to trade mid-range this afternoon. We now have a few options. Since action looks to be pretty tight, we can employ an intra range strategy and look to get in at a correction from resistance, with a short entry towards in term support at 239.85. In this scenario, we will look to define our risk with a stop loss somewhere around 246 flat.

Alternatively, we could look to get in long again on another upside break. With recent action in mind, if we do enter this one, we will keep our stop tighter than we did this morning – somewhere around current levels should do the trick.

If we run down to in term support and break below it, we will look for a close below 239.85 to validate a short entry towards an initial target of 236 flat.

Charts courtesy of Trading View