Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

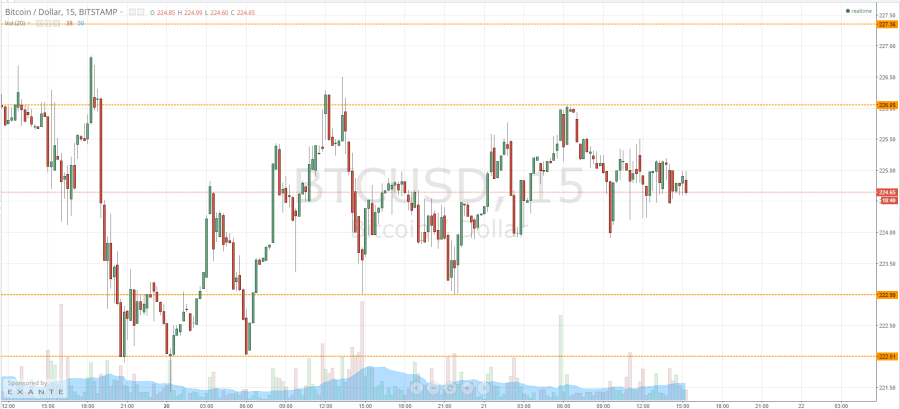

Early this morning, shortly before the markets opened in the UK, we published our twice-daily bitcoin price watch piece. In the piece, we commented on the overarching bullish momentum we saw throughout the Monday evening session, and suggested that today’s strategy might involve a couple of tight target-tight stop entries for an aggressive profit-taking position. Action throughout the day has now matured, so what did it bring, and what are the levels we’re keeping an eye on this evening to help form our intraday bias at European session close? Take a quick look at the chart.

As you can see from the chart, action throughout today has remained well within the parameters we highlighted in this morning’s piece, and the tight, range bound action has continued. As a result, the levels that we are watching this evening (GMT) remain exactly the same as those we’ve been keeping an eye on throughout the day. We’ve not entered any intraday trades as a result of today’s action, so we will be looking to get into a position on a signal tonight.

To reiterate what we said this morning, we will look for a close above 226.05 (in term support) to validate a short-term initial upside target of 227.36, with a stop around 225.5 keeping our risk parameters tight. Conversely, if we do manage to break towards 222.99, we will look for an initial run down towards 222 flat with a stop somewhere around 223.25.

Yes, the levels are tight, but with action as we have seen recently, scalping trades such as those outlined look to be the only way to draw an intraday profit from movements in the bitcoin price at present.

Which way are you looking? As ever, we are always interested to hear the opinions of traders on the site. Let us know!

Charts courtesy of Trading View

What happens if we break 235?