Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

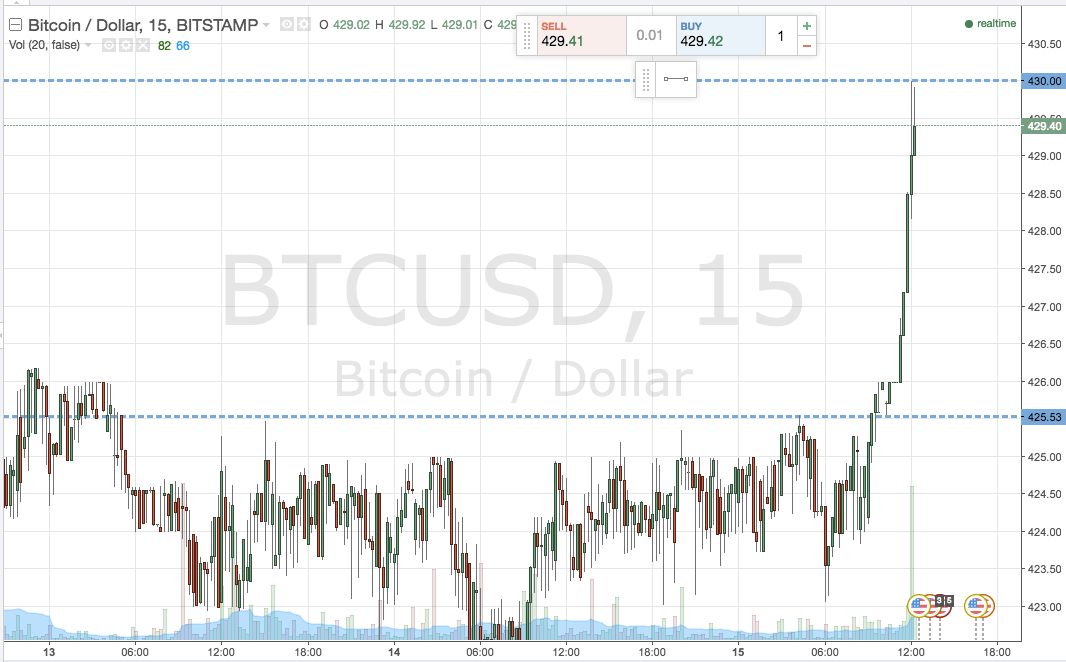

In this morning’s bitcoin price watch analysis, we suggested that we would like to see three things this by afternoon. First, a successful completion of our ongoing long trade. Second, a breakout on which we could get into a position, with the assumption being that this would be a long position and an upside break, if we were also going to fulfill item one. Third, a sustained move I the direction of our entry that would see us hit our target, and take us out of the trade for a profit as we headed into the weekend. Before we get going with our weekend key levels, take a look at the chart below.

As the chart shows, we hit all three of our items on the wish list. A breakout put us long towards 430, which we hit pretty quickly after entry, and the run ran through our previous long entry’s upside target. Good stuff.

So, with us ending the week on a high, what are we looking at as we head into this evening’s Friday close, and beyond that, into the weekend?

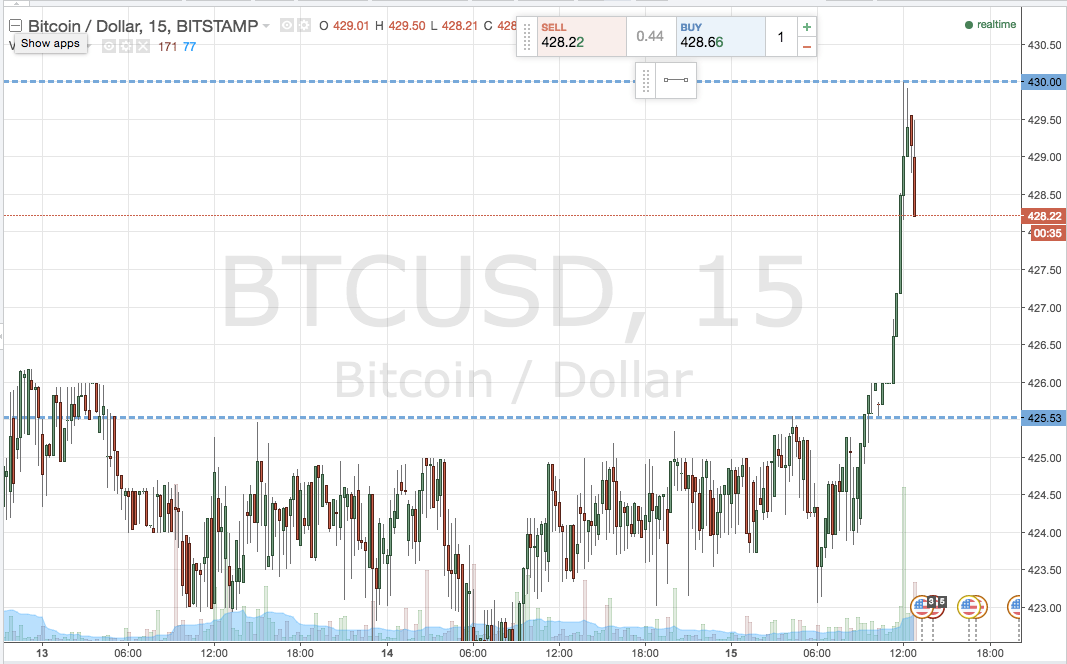

As ever, take a quick look at the chart to get an idea of the levels we are watching, and the targets we are going for on entry.

As the chart shows, we are looking at in term support of 425.53 (which was resistance, but now acts as support) and in term resistance at the most recent swing high (and our upside target on the last trade) of 430 flat.

We’ll be looking primarily at the breakout strategy for the weekend, so long on a close above resistance towards an initial upside target of 435. A stop at 428 defines risk on the trade.

Short on a close below support, target of 420 flat, stop at 427.5 to keep our downside risk tight.

Charts courtesy of Trading View