Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Patience is a key component of any financial asset trading strategy, and the last 48 hours or so have demanded plenty of it. Aside from the early morning breakout that reversed and took out our short position for a loss (the one we discussed in this morning’s bitcoin price watch article), we’ve had tow days of pretty flat trading, and no real entry points to speak of. Of course, when it comes to detailing this sort of analysis, to keep reiterating the same key levels doesn’t make for particularly compelling prose. With this in mind, for this afternoon’s session, we are going to shuffle things around a bit, tighten everything up and see if we can get come scalp profits under our belt. At the same time, we are going to maintain this morning’s breakout range, giving us two concurrent strategies – one short term and one slightly longer term (though still technically intraday).

For the longer term trades, check out the below chart – we wont go into detail here about it (as we would just be repeating this morning’s comments) but the key levels are highlighted, alongside the targets.

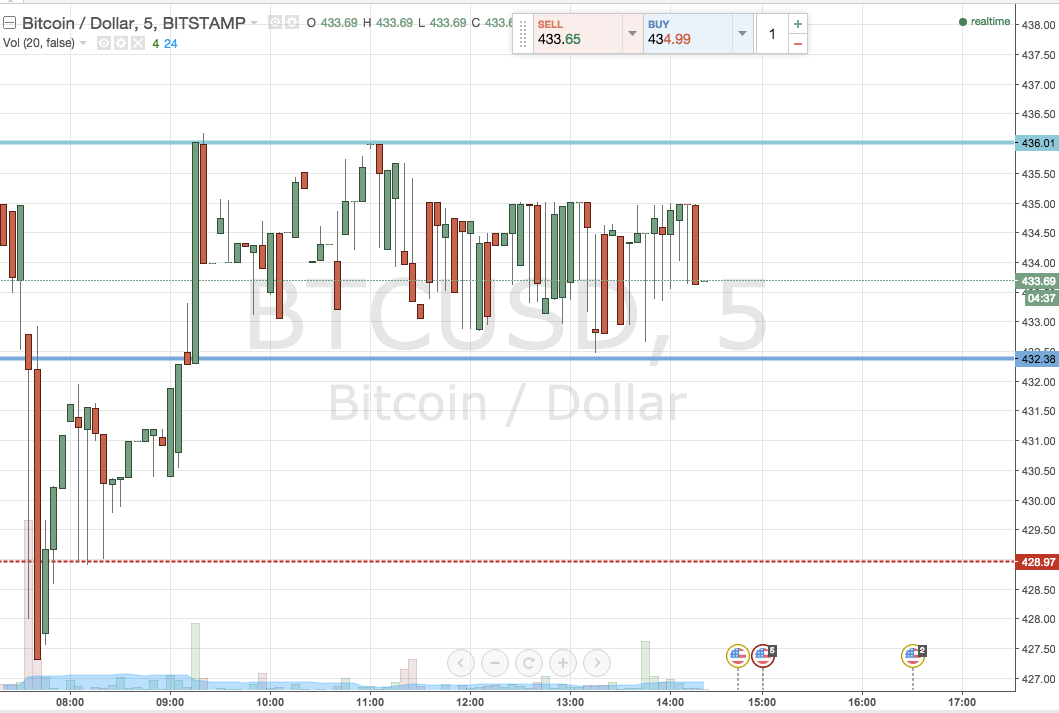

That out of the way, the chart below (chart 2) shows the range and levels we are looking at for tonight’s scalp strategy.

As the chart shows, the range is defined by in term support at 432.38 and in term resistance at 436 flat. It’s a scalp strategy, but at its core it’s still underpinned by breakout rules, so here’s how we’re looking at things.

A close below scalp range support will signal short entry towards an initial downside target of 429 flat. We need a really tight stop on this one, so somewhere in the region of 433.5 looks good.

Looking the other way, a close above in term resistance will put us long towards 440 flat, with a stop at 435 limiting our downside on the trade.

Charts courtesy of Trading View