Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

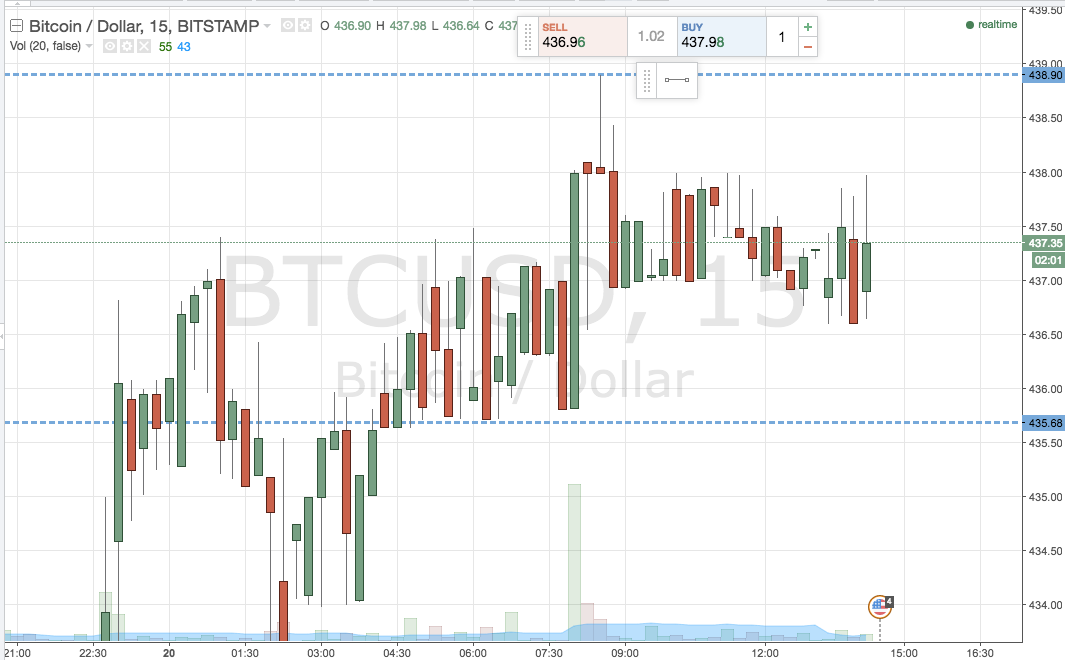

In this morning’s bitcoin price watch piece, our primary focus was on the upside momentum we saw throughout the evening and Asian session on Tuesday, and how we could interpret this action as far as gaining insight into today’s volatility was concerned. We noted that – since we had seen some pretty sharp movements overnight – we may see a consolidation of the upside run this morning, as speculators took profits on their long entries. As things turned out, our expectations for some consolidation proved valid. The bitcoin price has remained relatively flat throughout the day, and sideways trading has dominated for the most part. This doesn’t mean we will see a continuation of the range bound trading this evening, but it does slightly alter our approach going forward. Specifically, we are going to target a tighter range than usual, in an attempt to narrow things down and go for some short, sharp scalp trades.

So, with this in mind, ad ahead of the action tonight and the Asian session, here’s what we are focusing on in the bitcoin price. The chart below shows today’s action, with a fresh range overlaid.

As the chart shows, the range we are looking at tonight is defined by in term support at 435.68 to the downside, and in term resistance to the upside at 439 flat. We’ll be focusing purely on a breakout strategy for tonight.

So, for our breakout strategy, here’s what we’re going for:

A long entry on a close above in term resistance, with an initial upside target of 445 flat. Bear in mind that this is the highest level seen in the bitcoin price for a while, so a tight stop is required in case we see some upside friction – somewhere around 437.5 works well.

To the downside, a close below support signals short towards 430 flat. Stop at 437 to define upside risk.

Charts courtesy of Trading View