Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

In last night’s bitcoin price watch analysis piece, we highlighted a range that was quite a lot wider than those we have looked at across the last few weeks. This was in response to the volatility we saw over the weekend, and the opportunity this afforded us for an intra-range approach, rather than just our standard breakout strategy. Overnight, action didn’t mimic the volatility that we saw on Sunday, and pretty much just trended within the range we had predefined. Admittedly, it was a wide range, so it was optimistic to expects a sustained breakout, but that’s trading.

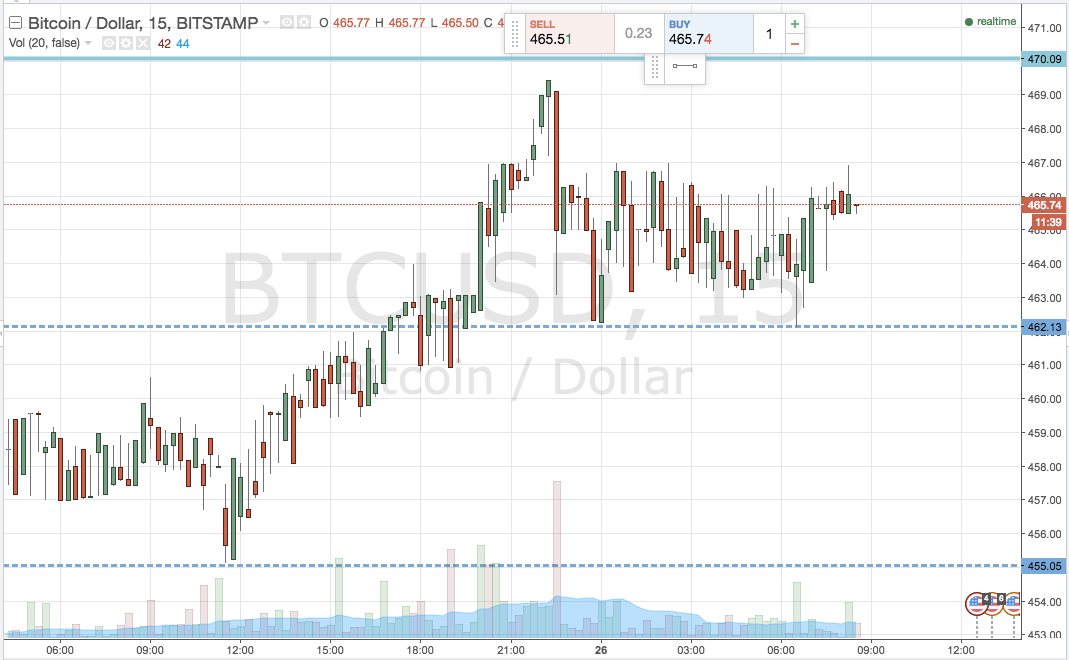

Anyway, action has now matured over night, and as we enter into a fresh European morning session, what are we are focusing on in the bitcoin price now, and where will we look to get in and out of markets if we get any volatility this morning? Take a quick look at the chart below to get an idea of the range we are focusing on.

As the chart shows, we are narrowing our range to focus on support to the downside at 462 and resistance to the upside at 470. With it being pretty tight, you will use only our breakout strategy that is, at least for this morning’s session.

So, according to our rules, will look to enter long on a break of resistance, with an initial upside target of 475. A stop loss on this one somewhere in the region of 467 defines risk nicely.

Looking the other way, if we see a close below support, it will signal a short entry towards a downside target of 455. Again we need a stop loss, and somewhere around current levels – 465 – looks good.

As a quick note, the overarching momentum looks to be to the upside, so we are focusing on a slightly more aggressive long entry than we are on our short position.

Charts courtesy of Trading View