Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

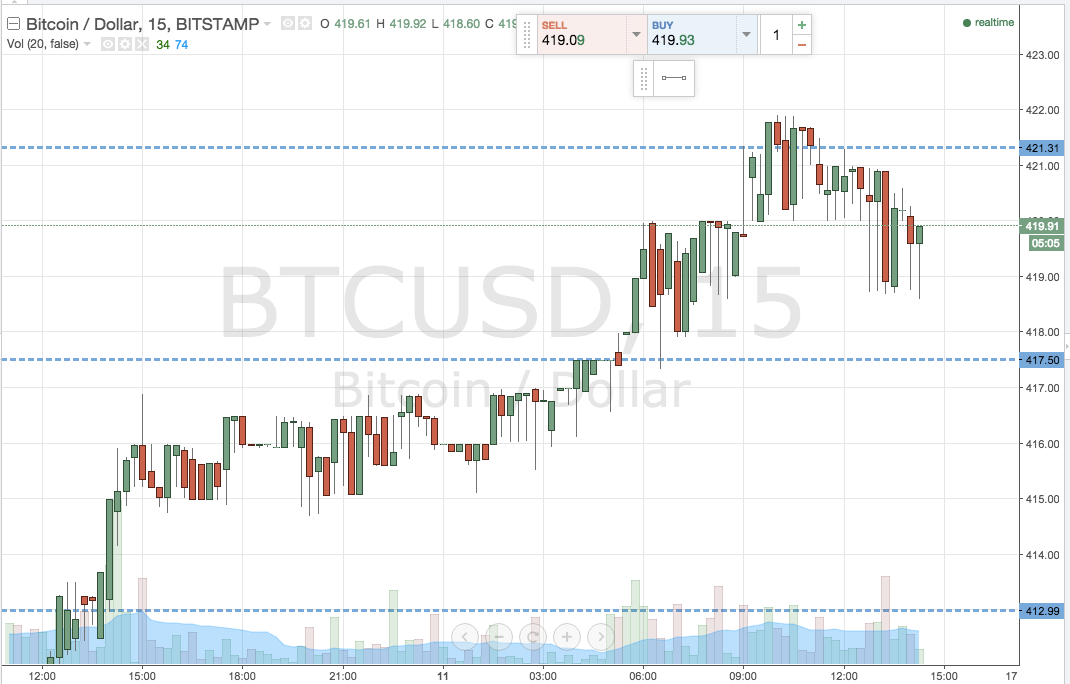

In this morning’s analysis, it looked as though we would be able to implement a pretty tight range and draw profit from any volatility on the breaking out of this range. Having widened this back out again to a more apt timeframe (when compared to yesterday evening’s session) we set up our parameters and risk management setting in anticipation of an entry. As things turned out, we did get an entry, but it didn’t work out exactly as we’d hoped. Take a quick look at the chart below to get an idea of what happened.

As the chart shows, the bitcoin price broke out to the upside above the in term resistance level we had slated this morning as being one to watch (421 flat), but quickly returned to trade within our range and took out our stop for a small loss on the position. We now trade mid range, and we are going to raise resistance to accommodate the latest break, but keep all the other parameters in place as per our outline this morning. Take a quick look at the chart below to get an idea of our refined range.

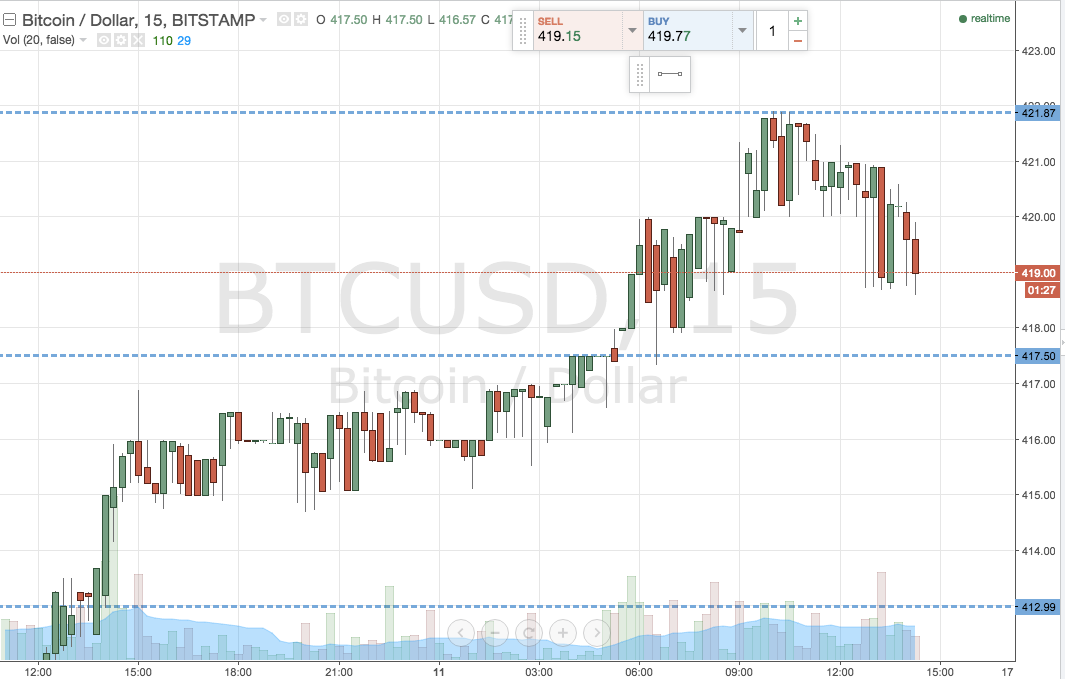

As the chart shows, new in term resistance comes in at the daily swing high of 422 flat, while as mentioned, in term support sits solid at 417.5.

We’ll be looking for a firm close below in term support to validate a short term bearish entry towards 413 flat, with a stop at 419.5 defining our upside risk on the trade.

Conversely, another break above resistance will once again put us long towards an upside target, in this instance, of 426 flat. A stop loss on this one somewhere in the region of 419 keeps things attractive from a risk management perspective.

Let’s see how things turn out…

Happy Trading!

Charts courtesy of Trading View