Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

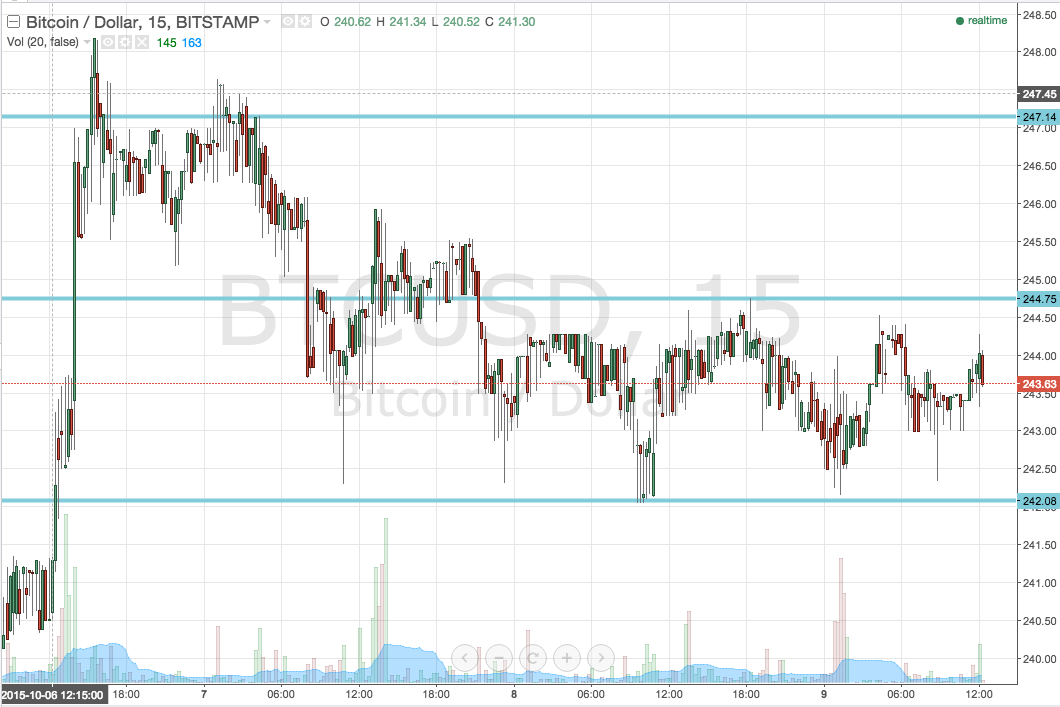

A little earlier on today, we published our twice daily bitcoin price watch piece. Based on the success of yesterday’s intra range approach, we suggested we would look to incorporate two separate strategies into today’s trading, and enter according to our key defined levels if either of the strategies afforded us an opportunity. Now action has matured over the European session, and as we head into the Asian session and, beyond that, the weekend, what are the levels that we are keeping an eye on – and can we move forward with both strategies? Take a quick look at the chart.

As you can see, the levels we slated as the ones to watch in this morning’s piece remain those that we will be watching this evening. Namely, these are 244.75 as in term resistance, and 242.08 as in term support.

Once again, we will forge forward with a combination of our two primary strategies – intra-range and breakout. If we see a bounce from support, it will put us long towards resistance with a stop just the other side of our entry. The same applies in reverse for a correction from resistance.

If we get a breakout through resistance, and a close above this level, it will put us long towards a medium term target of 247.14. A stop around current levels – 243.5 – should keep things attractive from a risk management perspective.

Looking the other way, a break below support would initiate a short entry toward 238 flat, while a stop around 243 will ensure we are taken out of the trade o the event that the bitcoin price reverses and returns to trade within our predefined range.

Charts courtesy of Trading View