Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

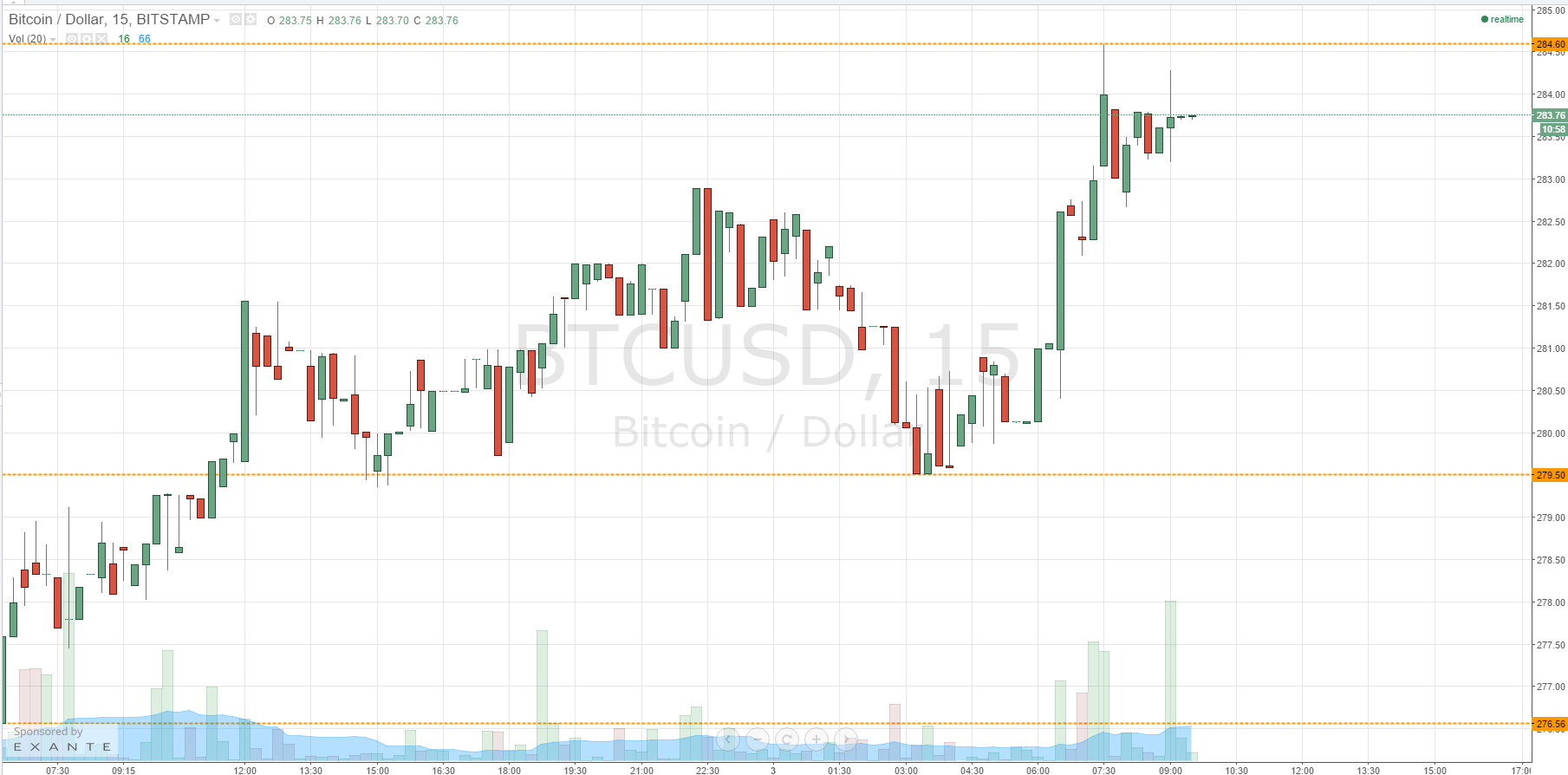

On Friday, we published our twice-daily bitcoin price watch piece. In the piece, we suggested that – as a result of the pretty weak action we had seen during the week – there may not be much we can do over the weekend as far as entering on volatility was concerned. As it happened, we did get a bit of action, and we managed to get in and out of the markets according to our intraday breakout strategy and draw a small profit from changes in the bitcoin price. Having said this, action throughout Sunday evening and Monday morning has been pretty flat. So, with this noted, what are we looking at during today’s session, and can we get in and out of the markets during Monday’s European session? Take a quick look at the chart.

As you can see, while action has been pretty flat overnight, we have got a little bit of upside momentum from which we can draw potential this morning. Current market price is around $283, and the two levels that we are watching are 279.5 as in term support and 284.6 as in term resistance. These are the levels that define our range during today’s European session.

We will initially look for a break above 284.6 to validate a medium-term bullish bias, with an upside target of 290 flat. On this trade, a stop loss somewhere around 284 flat leaves us plenty of room for profit. Looking the other way, a break below 279.5 would put us short towards 266 flat. On this trade, a stop loss somewhere around 281 will maintain a positive risk reward profile.

Charts courtesy of Trading View