Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

It’s the start of the European morning session, and finally, the bitcoin price has given us some action worth trading. The last few days have been relatively flat, with price either trading sideways or breaking out but returning to trade within range pretty much instantly – essentially, just chop out action.

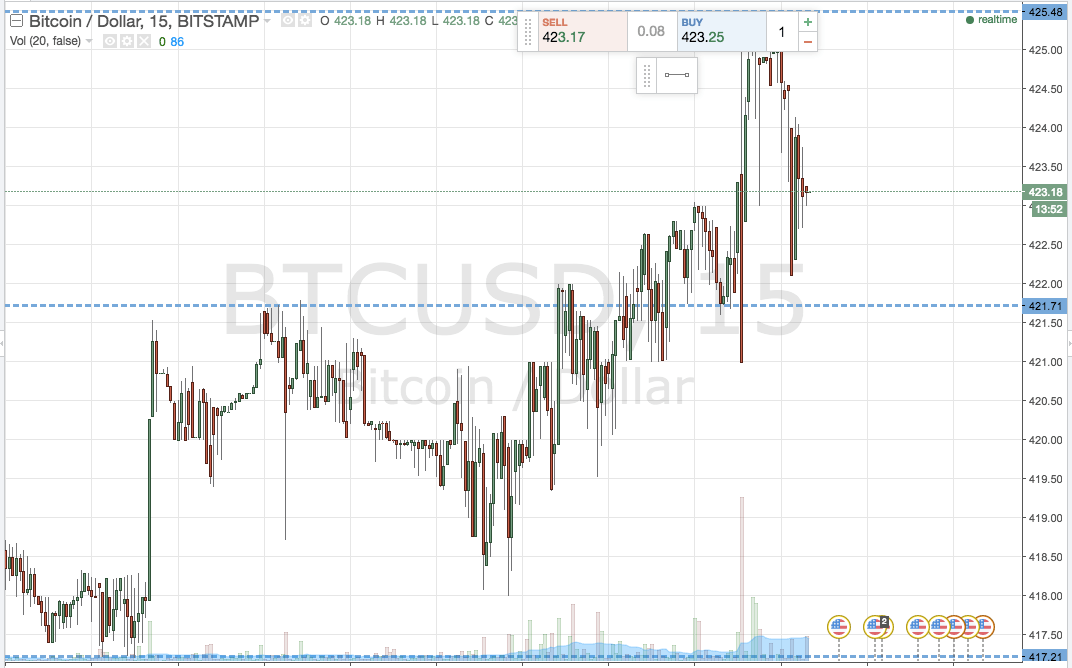

Overnight in Europe, however, things got a little more volatile. The bitcoin price broke through the level we had slated as in term resistance at last night’s session end analysis, and continued to gain to take out our target and to carve out fresh highs on the intraday chart of 425.48 – a level that will come into play as today’s session progresses.

With any luck, we’ll see some further upside, but from a short term perspective, any volatility will do – be it bullish or bearish. Current action is to the downside, with price correcting to its last swing low just ahead of 422 a little earlier on this morning, but this may just be a temporary correction and we might see a return to the upside shortly.

Regardless, here’s look at what we’re focusing on for today’s morning session – support, resistance, range and targets/risk management parameters. Take a look at the chart to get an idea of each of these levels as things stand.

As the chart shows, the two levels that define today’s range are in term support at 421.71 and in term resistance at 425.48. While it’s still a pretty tight range, the overnight volatility has given us a bit of room to play with. With this in mind, long at support and short at resistance as an intrarange play is valid.

From a breakout perspective, long on a close above resistance towards a target of 230, stop at 424 flat to define risk.

Conversely, short on a break of support, target at 417, stop at 423.45 to keep things tight.

Happy Trading!

Charts courtesy of Trading View