Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

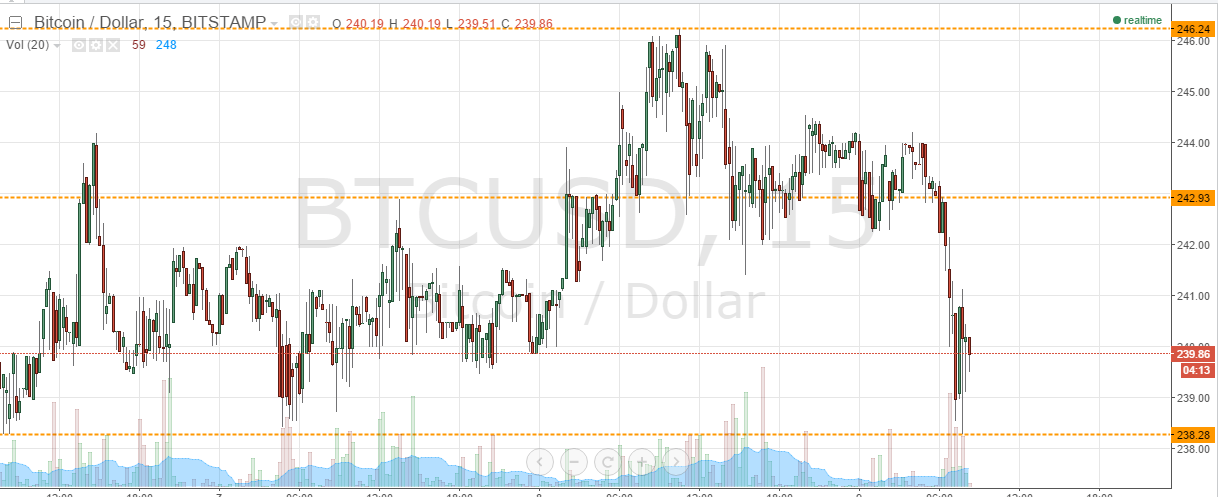

Staying on top of the bitcoin price over the last couple of weeks has been a tough task. While there have been some defined movements, they have primarily come during the Asian session, and often been short and pronounced. During the European session, conversely, we have seen pretty flat action – with the bitcoin price primarily ranging between tight parameters. With this said, we have still managed to get in and out of a number of trades, and so long as we continue to employ our intraday strategies will no doubt draw profit from the market. So, as we head into a fresh day’s European trading, what are the levels that we are keeping an eye on in the bitcoin price, and where will we look to get in and out of the market today? Take a quick look at the chart.

As you see, action overnight brought the bitcoin price to trade down slightly, currently just ahead of 240 flat as we kick off today’s session. In term support sits at 238.28, while resistance is at 242.934 today. We will initially look for a bounce from support to put us in a long entry towards resistance. We hit support a little earlier on this morning, but we would like price to touch it again before we get in, and a stop loss somewhere around 237 flat will help us to maintain a positive risk reward profile.

If we break down below support, we will look to enter short with a target of 235 flat and stop loss at 239. Looking the other way, if we run up towards in term resistance, it will give us an opportunity to enter long on a break of this level towards 246.24 as an initial upside target, with a stop loss somewhere around 241.5 keeping things attractive from a risk management perspective.

Charts courtesy of Trading View