Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

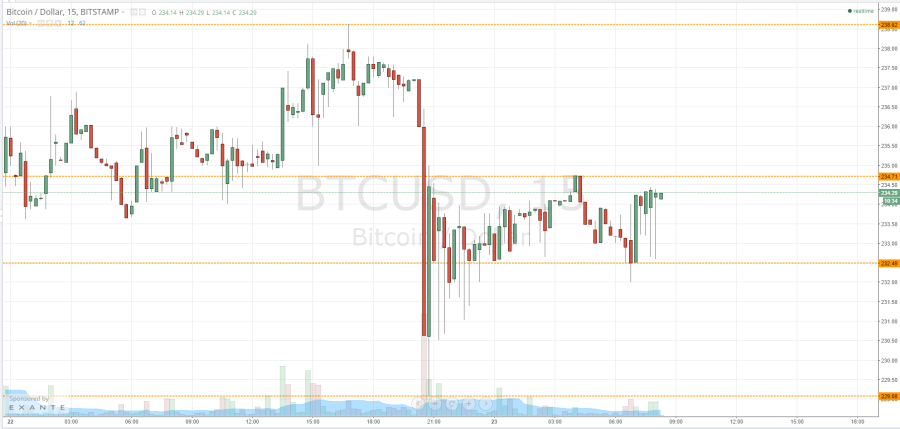

Yesterday afternoon we saw the bitcoin price breakout of its intraday range (the parameters of which we highlighted in the mornings bitcoin price watch piece), and we published our analysis shortly before the markets closed in Europe offering up the levels we were keeping an eye on in the bitcoin price overnight and what the breaking of these levels would mean as far as our intraday positions were concerned. Now action has matured, we have a few new levels to watch. What are these levels, and how might we enter a position in the BTCUSD today? Take a quick look at the chart.

As you can see, having broken out of our slated range yesterday, we hit highs of 238.62 before breaking back to the downside to trade within the parameters of what now serves as today’s range between in term support at 232.49 and resistance at 234.71. These are the levels we’re watching this morning.

If we get a break above 234.71, and a close above this level, we will look for an initial upside run towards a target of 238.62. On this entry, a stop loss somewhere around 233.50 (mid-range at present) will ensure we are taken out of the trade in the event of a bias reversal.

Looking the other way, if we get a break below 232.49, it would give us a reason to enter short towards last night’s lows just shy of 230 flat. Once again, if we do enter a position towards this level, a stop loss somewhere around 233.5 will keep our risk parameters positive and ensure we don’t find ourselves on the wrong end of an upside spike.

As a quick side note, while often we will trade a range (sell at resistance buy at support) today’s range is likely a little bit too tight to do this.

Charts courtesy of Trading View