We’re coming to the end of the day on Tuesday out of Europe and it’s time to take a second look at the bitcoin price in an attempt to figure out how best to approach the market this evening, during the US afternoon session and beyond into the Asian open. Action today has been pretty interesting, so before we get into the strategy we are looking at for this evening, let’s address what happened during today’s session first.

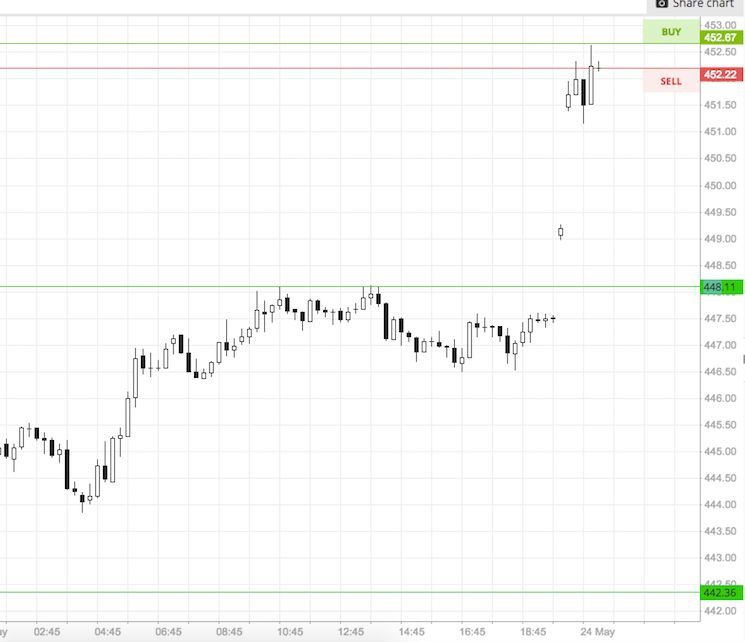

Specifically, we want to look at a gap up in the bitcoin price that took place a couple of hours ago. The gap is illustrated on the chart below.

As the chart shows, price gapped through our resistance level to carve out fresh intraday highs juts short of our upside target at 453 flat. We entered the trade on the gap up, and remain in the trade as things stand. As such, we wont be looking to get into any fresh trades this evening (at least, that is, until the trade we are in resolves).

For those not yet in a trade, however, here’s a look at what we are focusing on (and what we will enter on if action takes out our target near term this evening.

Take a look at the second chart below to see what we are looking at.

As the chart shows, in line with the gap to the upside, we have shifted our range to in term support at 448 flat, and in term resistance at the most recent swing high at 452.63. This range is tight, so it’s a breakout focus only.

We will look for a close above resistance to signal a long trade towards an initial upside target of 458. A stop at 450 flat defines risk.

A close below support signals short towards 442. Stop at 450 flat.

Charts courtesy of SimpleFX

Header Image NewsBTC