Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

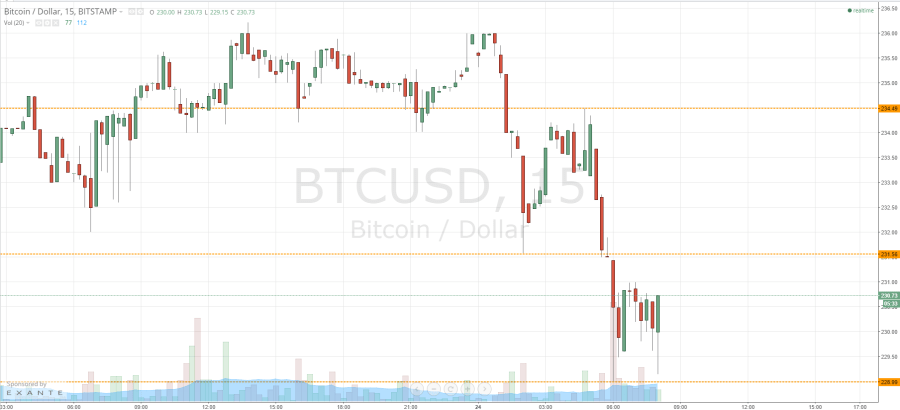

Yesterday afternoon, shortly before the markets closed in the UK, we published our twice-daily bitcoin price action piece – with a focus on the key levels we would be looking at as we headed into the US afternoon session and beyond. Now action has matured overnight, we have seen some sharp movement in the BTCUSD, and we’re looking at a fresh set of key levels during Friday’s trading. With this said, what are the levels we are keeping an eye on, and how might we enter on a potential breaking of these levels. Take a quick look at the chart.

As you can see from the chart, having traded sideways for the majority of yesterday afternoon/evening, the bitcoin price collapsed from intraday highs around 236 flat just ahead of 2 AM GMT, and – while it found a temporary reprieve at 231.564, followed by a short term upide correction towards 234.49, the downside momentum continued to current levels. Now, in term support lies at 228.99 (the daily low) while resistance sits currently at the aforementioned 231.56. These are the two primary levels to keep an eye on today.

If we can get a break back up towards 231.56, we will look for an upside entry with an initial, medium term, upside target of 234.49. With this trade, a stop loss just below 231.56 (somewhere around 231.0 flat) will ensure we are taken out of the trade in the event of a bias reversal. Looking the other way, if we get a break towards 228.99 (in term support) and a close below this level, it would present us with further downside momentum and we will enter short towards 225 flat, with a stop loss at 230 flat giving us a nice risk reward ratio and making sure we don’t get caught out on the wrong side of an upside spike.

Charts courtesy of Trading View