Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

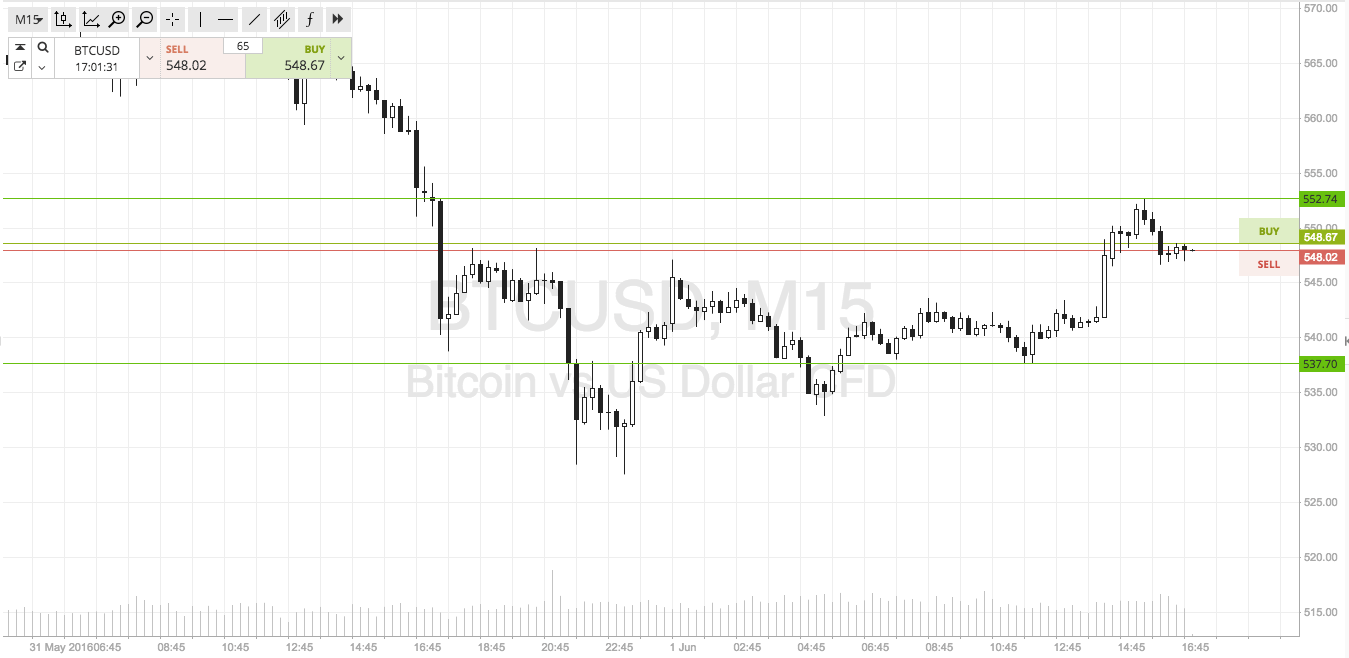

In this morning’s article, the primary focus was the widening out of our bitcoin price range, and how we would use this wide range to trade an intrarange strategy. Ironically, it’s the first time we’ve done this in a couple of weeks, and it has gone against us. Normally, we implement a breakout strategy in anticipation of price breaking through our key levels and continuing as part of a sustained run in a particular direction – be that long or short. In this instance, however, we looked to trade on a correction from resistance (entering short toward support) or on a bounce from support (long towards resistance). We did this, and then action went and broke through resistance earlier on today, taking us out of a trade for a small stop loss hit and rendering our strategy invalid for the remainder of the session.

We are now about to head into the close of the European session, however, and we can take into account recent action to implement a breakout strategy this evening. So, with this said, and as we move forward, here are the levels we are focusing on for this evening’s session.

As the chart shows, tonight’s interim support sits at 537, while resistance to the upside comes in at 552. This latter level is the most recent swing high, so let’s address this first. If price breaks above resistance, we will look to enter long towards an initial upside target of 560. A stop loss on this one somewhere in the region of current levels – i.e. 548 – works well to define risk. Looking the other way, if price breaks below support it will signal a short trade towards 530. A stop loss at 540 keeps things tight to the upside.

So that’s it for tonight, dropping the intrarange approach and moving forward with a strict breakout strategy. Watch us get chopped out again…

Whatever happens – Happy Trading!

Charts courtesy of SimpleFX