Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

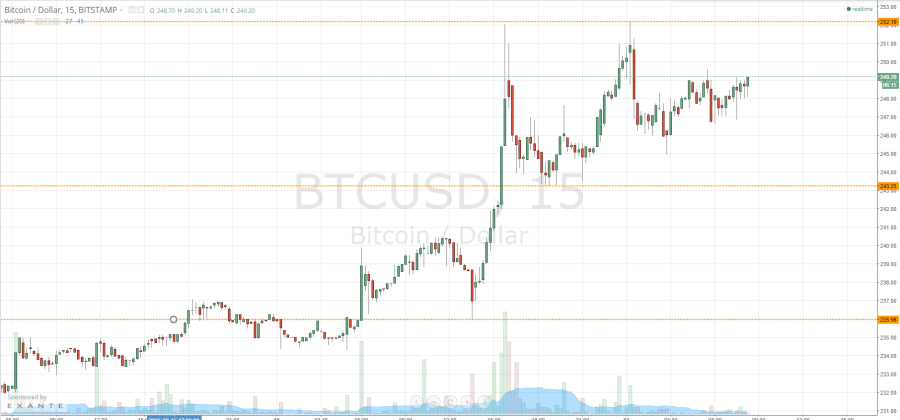

Yesterday evening we published our thoughts on the bitcoin price movement we had seen throughout the day on Tuesday in our twice-daily bitcoin price watch piece. We noted that there has been a considerable amount of upside momentum throughout the day, and that managed to enter and exit on this momentum to draw profit from the market according to our intraday scalp strategy. Now action has matured overnight, and the European session is about to kick off for a fresh day of trading, what are the levels we are keeping an eye on now, and where will be looking to enter on today’s action? Take a quick look at the chart.

As you can see, having hit highs yesterday night of 252.19, the bitcoin price corrected a little bit and we are now trading just shy of those eyes, within a range defined by in term support at 243.25 and resistance at 252.19. These are the two levels that we will be watching as we head into today’s session.

If we can get a return to the upside momentum that we saw yesterday, we will look for a break above 252.19 to put us long towards an initial upside target of 255 flat. With about three dollars worth of reward, a stop loss somewhere around 251 maintains a positive risk reward profile and make the trade worthwhile from a risk management perspective.

Looking the other way, if resistance holds firm, and we get a run down towards in term support, a break below this level and close on an intraday basis would bring 235.98 into play medium-term. This one is little wider than the other as far as reward is concerned, so a stop loss somewhere around 247 flat will ensure we are taken out of the trade in the event of a bias reversal and do not get caught on the wrong end of an upside run.

Charts courtesy of Trading View