Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

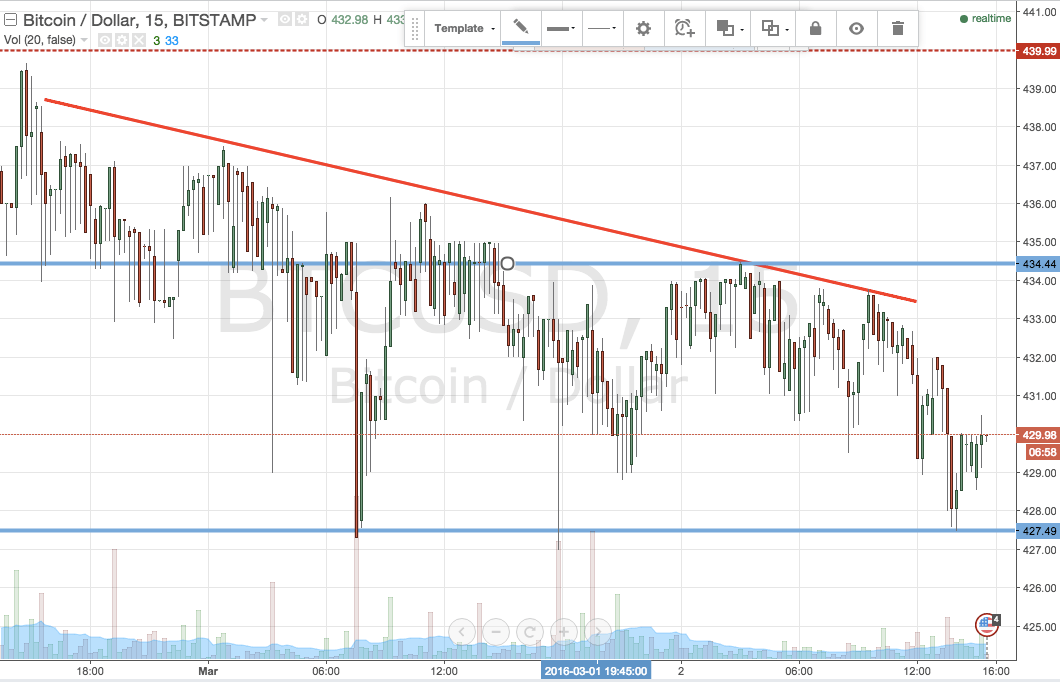

In this morning’s analysis, we noted that a downward sloping channel offered up the potential for an upside break, and in turn, some strength in the bitcoin price throughout the Wednesday European session. It’s been about seven hours since we released our interpretation of last night’s action, and things haven’t exactly played out as expected. We got a downside break that put us in a medium term short trade, but a quick reversal leaves us currently just shy of an afternoon stop loss hit. We are still within this morning’s range, and in a trade as things stand currently (albeit one that’s likely to close out shortly), so we won’t be getting back into the markets until we are net flat. For those not yet in a trade, however, there’s plenty to watch as we head into tonight’s session and beyond, into the Asian open.

With this in mind, let’s take a look at some refined key levels, and see if we can’t slate some profitable positions for the volatility going forward. Here goes. As ever, get a quick look at the chart to see what’s going on.

As you can see from the chart, in term support sits at 427.49 (this afternoon’s swing low) and in term resistance comes in at 434.44 – the same level we noted this morning as one to watch.

We’ve got just enough room to bring our intrarange strategy into play, so for those looking to take advantage of sideways actions, long at support and short at resistance, stop just the other side of the entry.

Looking at breakout, a close below support signals short towards 420 flat. Stop just above at 429 flat.

If price breaks and closes above resistance, it will put us long towards this morning’s predetermined target of 440 flat.

Happy Trading!

Charts courtesy of Trading View.