Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

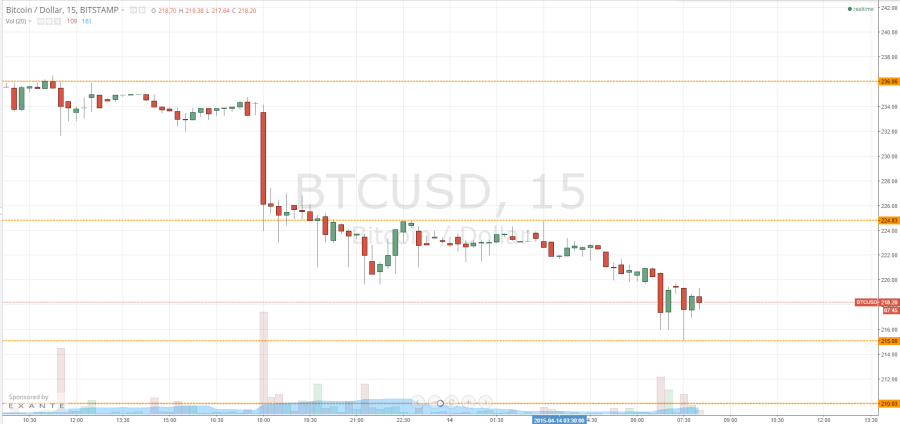

Yesterday afternoon, shortly before the markets closed in the UK, we published our bitcoin price watch piece highlighting the levels we would be keeping an eye on in the BTCUSD as the bitcoin price matured overnight. We’ve seen some considerable movement throughout this maturity, and our parameters – in terms of levels to watch – have changed. With this said, what happened overnight, and what will action around particular levels tells about a potential intraday bias as we head into a fresh day of trading? Take a quick look at the chart.

As you can see, action in the bitcoin price overnight saw a sharp decline through 232.0 flat, to an initial floor just shy of 220. Having traded along resistance/support throughout the early hours, we once again saw a break towards what now serves as in term support at 215.09. This, alongside 224.83, is the level to watch.

With the current overarching momentum to the downside, it’s difficult not to lean towards a medium-term bearish bias in the bitcoin price. However, we’ve seen on numerous occasions price reach floors and reverse quickly, so – while our bias remains to the downside – we must take into consideration a potential reversal and how we might respond. First, let’s cater to the bears. We will look for a break of 215.09 to signal a short entry towards 210 flat, with a stop loss around 216.5.

If, however, 215.09 holds firm of support, we can do one of two things. The first, an aggressive entry towards 224.83, with a stop just shy of 215 (somewhere around 214 flat). The second, wait until we reach 224.83, and enter long on a break of this level towards 236.06. In this scenario, a stop somewhere around 222 flat would give us a nice risk reward profile and cover any large losses against a reversal.

Charts courtesy of Trading View

Firm? The bear is laying the smack down on the bull as we speak. That or the world has woken up and realized that btc is a farce and the value is in free fall.