Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

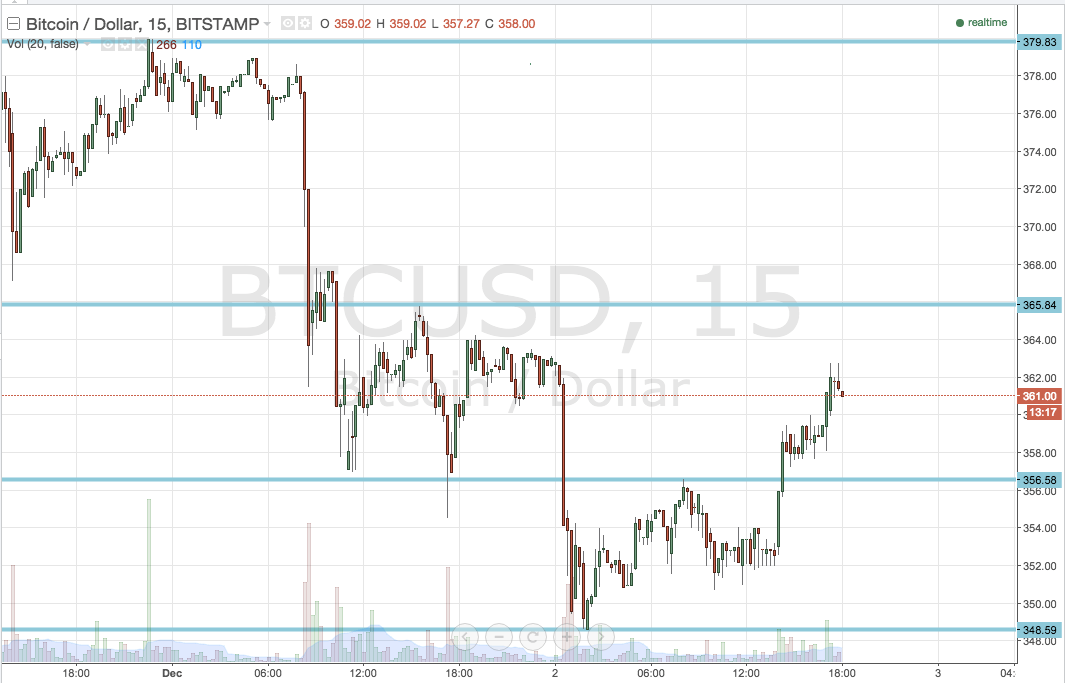

Once again we’ve had a bit of a wild day in the bitcoin price. Having consolidated overnight in response to yesterday’s collapse, the bitcoin price found intraday lows at 348.59. From this level, today’s action has seen a rise up and through the level we predefined as this morning’s resistance, 356.58, and put us in a long trade towards 365.84. In light of this, we wont be initiating any fresh positions until this one closes out – either through the hitting of our stop loss or our predefined target at 368.54. For those not yet in a trade, however, here are the levels to keep an eye on tonight.

First up, support. With price having broken though resistance today, that level now serves as in term support – specifically the aforementioned 356.58. In term resistance comes in at our current target – 365.84.

Since we are currently enjoying some upside momentum, let’s address that the upside first. If we see a break of in term resistance, and get a close above this level on the intraday chart, we will enter long towards 379.83, intraday highs from yesterday. This is quite a wide range target, so we’ve got a little bit of room to play with from a risk management perspective. In light of this, a stop loss somewhere in the region of 361 (current levels) works nicely.

Now for the downside. A break below in term support will put us short towards 348.59, with a stop loss in the 358 flat spot keeping things attractive on the risk management side of things.

As a final note, intrarange is on for those looking to pick up an aggressive entry on any consolidatory action. Long on a bounce from support and short on a corrective return from resistance, with a stop just the other side of entry defining our risk.

Charts courtesy of Trading View

Samuel – I have a few bitcoins in myTrezor , how does one get signals and what platform allows you to trade BTC? Thank you ahead of time (I am really looking for a “signal” provider for BTC) Pointing me in the right direction is greatly appreciated. Ive self taught and learned MetaTrader 4 for Forex but as far as knowing the proper buy and sell orders I need help in that direction.. Appreciate your help