Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

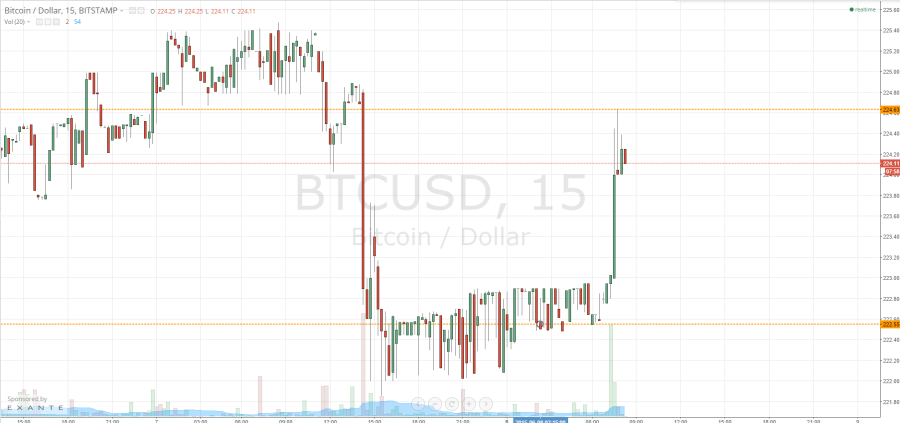

On Friday evening, shortly before the markets closed in the US, we published our twice-daily bitcoin price watch analysis piece highlighting the action we had seen in bitcoin throughout Friday’s session, and suggesting a couple of the key levels that we would be keeping an eye on over the weekend. We highlighted a couple of targets that – in the event of a breakout – we could draw entry upon, and suggested where our risk management parameters best lay. Now, action has matured over the weekend, and we have seen quite a lot of volatility. With this said, what are the levels we are keeping an eye on in the bitcoin price today, and how can we draw a profit from the market according to our scalp strategy? Take a look at the chart.

As the chart shows, action during Sunday’s session held all the volatility. First, we saw a sharp decline towards lows just ahead of 221.80, followed by a quick recovery and a run up this morning to daily highs of 224.63. The aforementioned of these two levels now serves as in term resistance. In term support sits at 222.55.

If we get a break above 224.63, it will put us long towards an initial upside target of 229 flat. A stop loss somewhere around 223.60 will take us out of the trade in the event of a bias reversal.

Looking the other way, if current levels hold and we get a run back towards 222.55 (in term support) we will look for a close below this level to validate an initial downside target of 220 flat, with a stop loss somewhere around 223 maintaining a positive risk reward profile. An aggressive short entry could be back down towards in term support from current levels, with a stop loss around 225 flat if resistance holds and we get a range bound bear run.

Charts courtesy of Trading View