Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

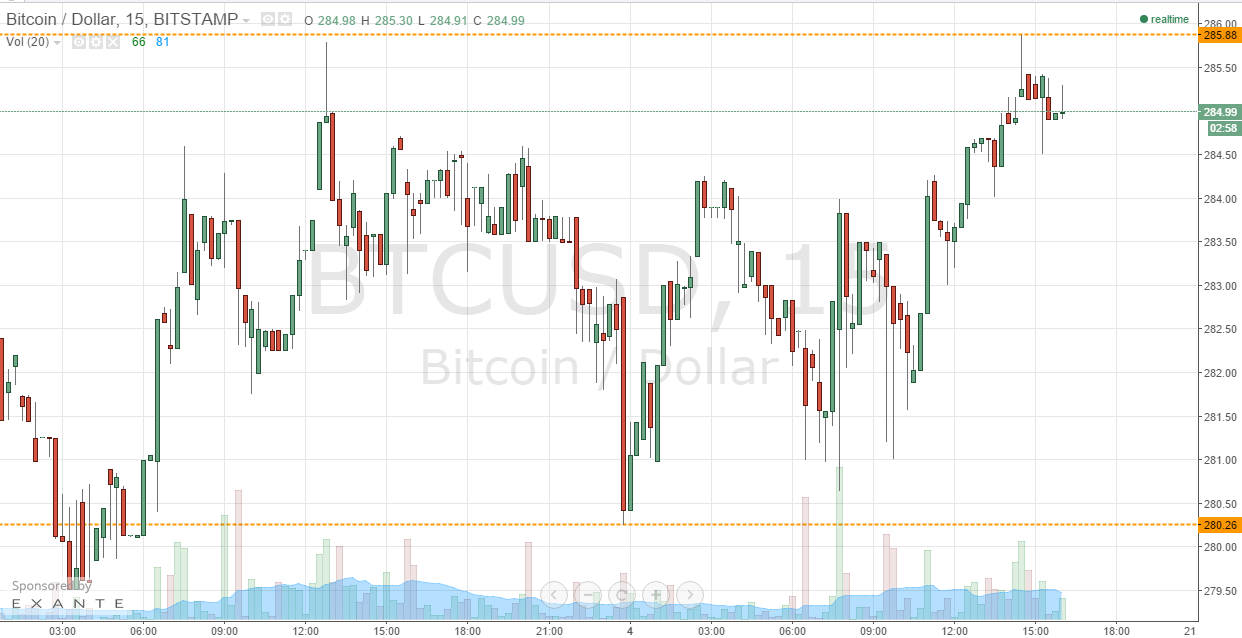

In this morning’s bitcoin price watch piece, we highlighted the levels that we would be keeping an eye on throughout Tuesday’s European session, and suggested where we would look to get in and out of the market according to our intraday breakout strategy. Action has now matured throughout the day, and we have seen some pretty interesting movement likely driven by fundamental factors. So, with this said, what are the levels that we are keeping an eye on in the bitcoin price this evening, and how can we get in and out of the markets according to our strategy throughout the Asian session? Take a quick look at the chart.

As you can see, action has been pretty volatile today, but – and luckily for us – towards the upside. Having opened the day somewhere around the low 280’s, we have traded up a few dollars to carve out intraday highs mid-afternoon (GMT) of 285.88. This level gives us in term resistance for this evening. In term support sits at 280.26 – overnight lows on Monday.

We will initially look for a trade in line with the current overarching bullish momentum, so a break above 285.88 would put us long towards a medium-term upside target of 290 flat. This is a level that we have been targeting some time now, and have repeatedly failed to reach, so a tight stop loss is warranted. Somewhere around 285 flat will keep things nice and protected to the downside.

Looking the other way, if we can get a bounce from current levels, we will look for a short intra range trade towards a medium-term downside target of in term support at 280.26. A stop loss just above in term resistance will help us to maintain a positive risk reward profile on this trade, and take us out of the short entry in the event that we get a bias reversal.

Charts courtesy of Trading View