Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin Price Key Highlights

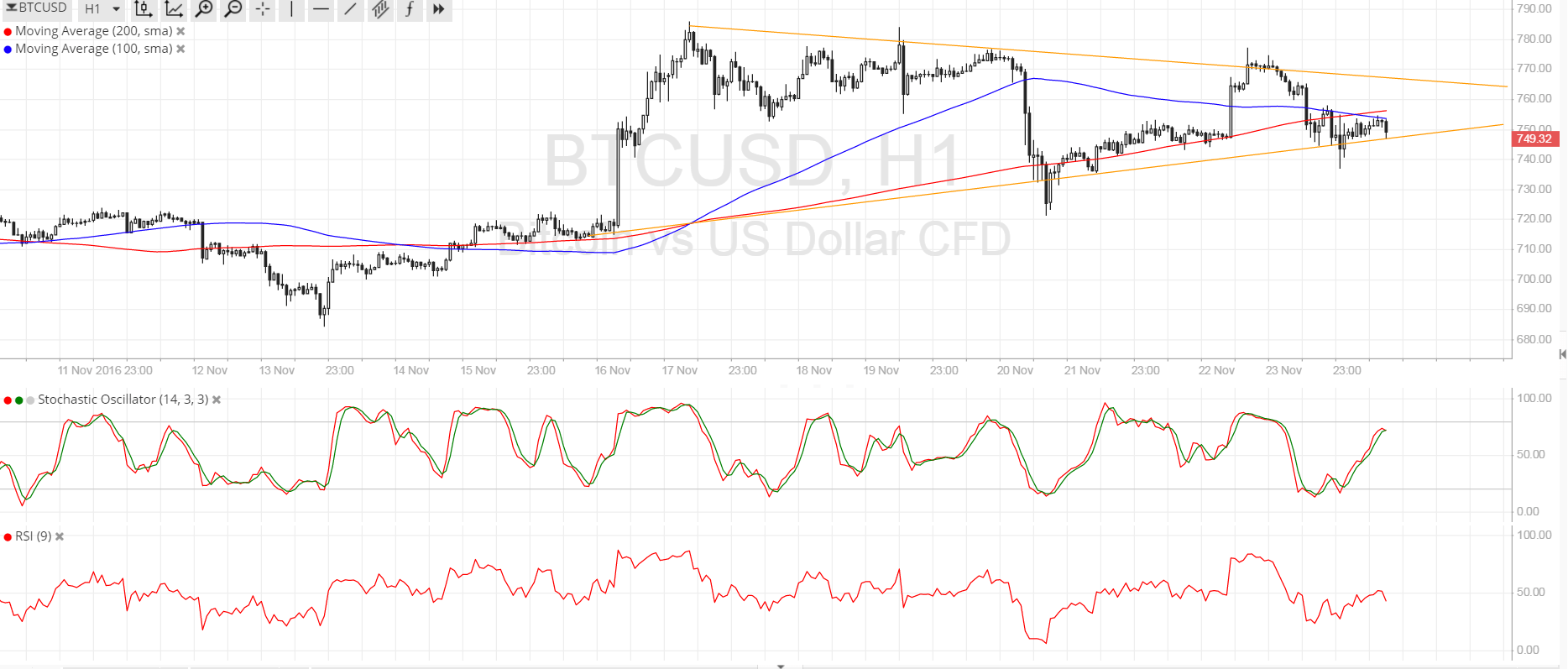

- Bitcoin price has formed lower highs and higher lows, creating a symmetrical triangle pattern visible on its short-term chart.

- Price is currently testing support and might be due for a bounce back to the resistance.

- Technical indicators are giving mixed signals, although a downside break seems possible.

Bitcoin price is consolidating inside a symmetrical triangle formation, possibly gearing up for a strong breakout.

Technical Indicators Signals

The 100 SMA just crossed below the longer-term 200 SMA to indicate that the path of least resistance is to the downside. In other words, a break lower could be more likely than an upside breakout from the resistance near the yearly highs as bullish momentum is slowing.

Stochastic is on the move up to show that buyers are still in control of bitcoin price action, suggesting that another test of the triangle resistance around $760-765 could be in the cards. Once the oscillator reaches the overbought zone and turns lower, selling pressure could return and force a move below $750.

RSI is on middle ground, barely offering strong directional clues at the moment. It appears to be on its way down, though, so bearish pressure is still present.

Market Events

Bitcoin price has been on a tear lately, owing to the influx of investing activity from Chinese investors seeking to hedge against their yuan-denominated holdings. The Chinese government has been setting the trading band lower in order to engineer local currency depreciation and maintain its advantage in trade, thereby eroding returns in Chinese investments.

However, the US dollar is putting up a fight against bitcoin price, especially since the Fed is moving closer towards hiking interest rates next month. A 0.25% hike seems to be in the bag, as confirmed by the FOMC minutes and Fed Chairperson Yellen’s testimony.

FOMC minutes revealed that majority of policymakers thought that a rate hike is appropriate soon since this would prevent the economy from overheating as it approaches full employment and is looking at a likely increase in fiscal stimulus from the Trump administration. Profit-taking ahead of the Thanksgiving holidays has weighed on bitcoin gains but thinner liquidity this long weekend could set the stage for more volatile breakouts.

Charts from SimpleFX