Bitcoin Price Key Highlights

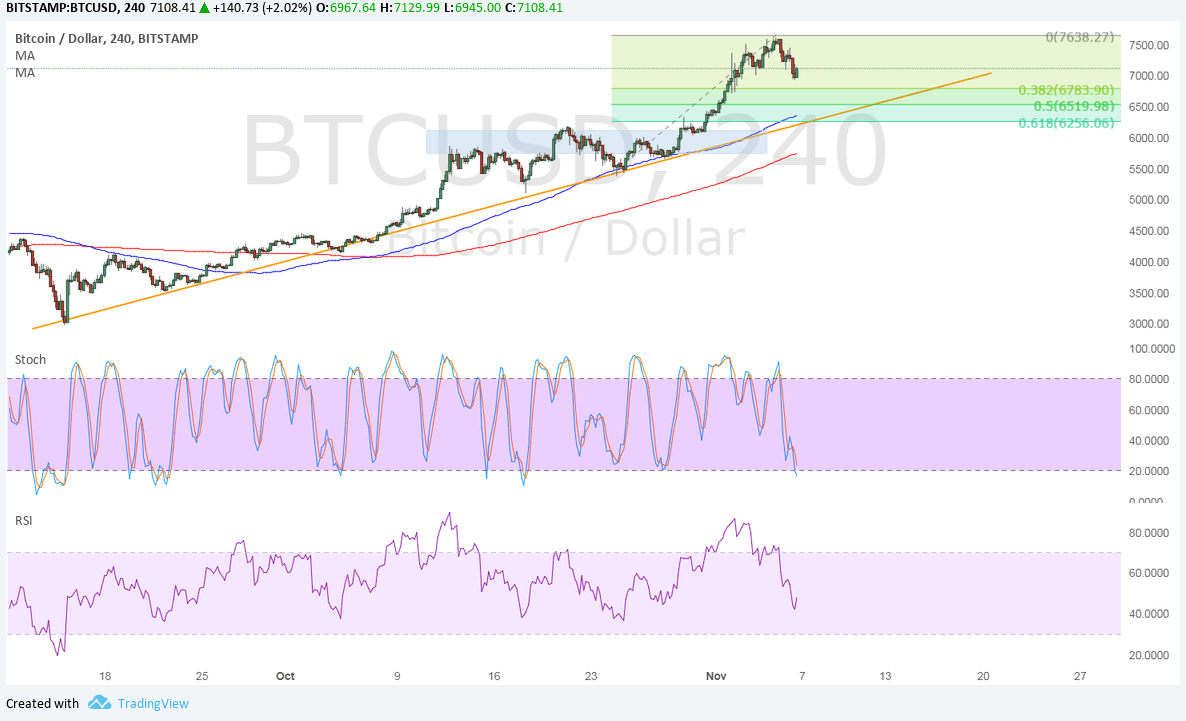

- Bitcoin price is still in correction mode and looks ready to pull back to the Fibonacci retracement levels on the 4-hour time frame.

- Technical indicators are signaling that the uptrend could carry on once the correction is completed.

- Sentiment for the cryptocurrency remains positive but investors could be paring risk as exchanges are prepping for the network upgrade next week.

Bitcoin price is pulling back to the area of interest as the upgrade looms, but bulls could be waiting to go long at lower prices.

Technical Indicators Signals

The 100 SMA is above the longer-term 200 SMA so the path of least resistance is to the upside. This means that the uptrend is more likely to resume than to reverse.

The 100 SMA is close to the 61.8% Fibonacci retracement level at the $6256.06 level and the ascending trend line connecting the lows over the past month. The gap between the moving averages has been maintained, which signals consistent bullish pressure.

Stochastic is heading south so bitcoin price could keep the following suit until buying momentum returns. RSI has more room to tumble so the correction could stay in play for a while until both oscillators indicate oversold conditions and turn back up.

A larger pullback could last until the broken resistance around $5800-6000, which is closer to the 200 SMA dynamic inflection point.

Market Factors

The bitcoin network upgrade is due to take place in a week and it’s understandable that investors are starting to pare their risk ahead of this event risk. If it turns out anything like the previous hard fork, bitcoin price could be poised to reestablish its uptrend and possibly go for new highs after the upgrade.

Meanwhile, the US dollar is under a bit of selling pressure on a foreseen shift in the Fed’s bias as hawkish member Dudley announced his retirement plans in mid-2018. So far, the tax reform is still facing plenty of headwinds, which could also keep the currency’s gains in check for the time being.

SaveSave