Bitcoin Price Key Highlights

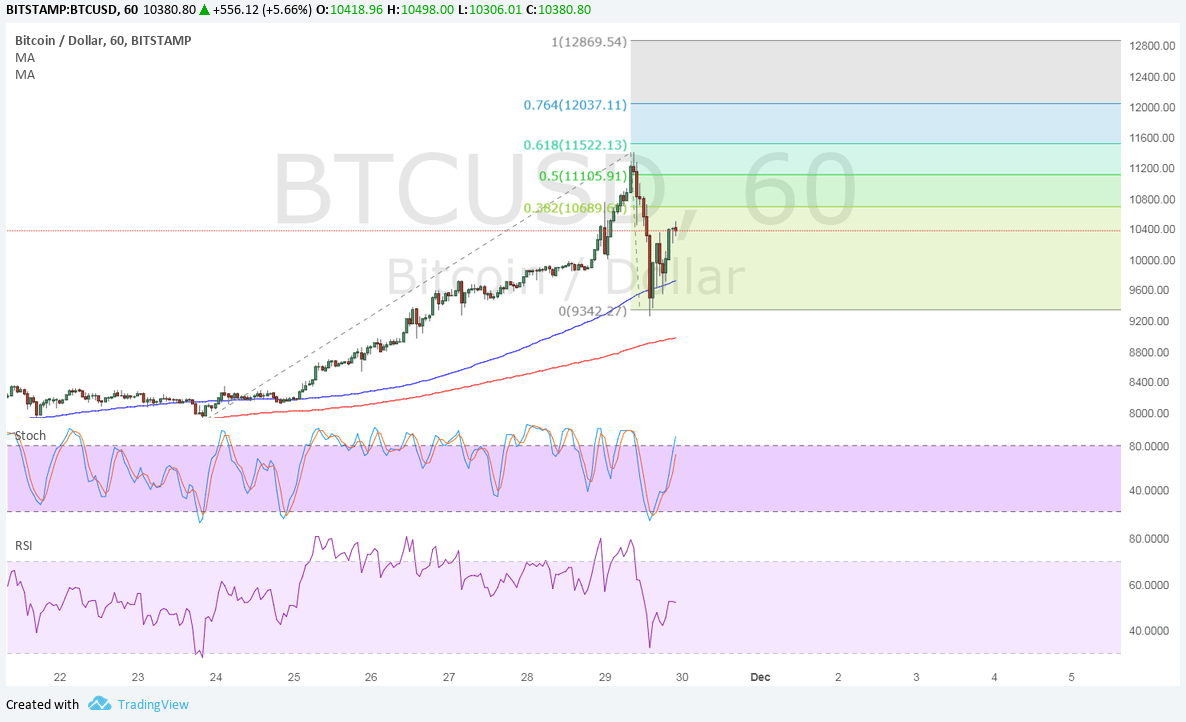

- Bitcoin price has retreated sharply from a similarly steep climb but is regaining ground once more.

- Bulls appear to have returned on a pullback to the $9350 area and could take price back up to the nearby resistance levels.

- Applying the Fib extension tool shows how high bitcoin price could go from here.

Bitcoin price appears to have completed its pullback from the strong rally recently, allowing the uptrend to resume.

Technical Indicators Signals

The 100 SMA is above the longer-term 200 SMA on the 1-hour time frame so the path of least resistance is to the upside. The short-term moving average also held as dynamic support on the latest pullback, and its gap with the 200 SMA is widening to reflect stronger bullish momentum.

Stochastic is also heading north so bitcoin price could follow suit. However, this oscillator is already approaching the overbought zone to reflect weakening buying pressure. RSI has pulled up from the oversold region to indicate a return in bullish momentum and has more room to climb before hitting overbought levels.

Bitcoin price could climb to the 38.2% Fib next at $10700 then at the 50% extension close to the swing high at $11,105. From there, price could attempt to create new highs at the 61.8% extension or $11,522 then at the 76.4% extension at $12,037.11. The full extension is located at $12,869.54.

Market Factors

The increase in retail activity and trading volumes owing to the addition of 100,000 Coinbase accounts last week has been considered the main factor propping bitcoin price up. There’s also the anticipation for the CME bitcoin futures launch later this year that could potentially draw even more investors.

Dollar demand has ticked higher on progress in tax reform, though, and clearing Senate this week could mean more gains. Then again, lawmakers have to merge the existing versions from the House and Senate before getting it through to the White House.

The US currency has also drawn support from a GDP upgrade from 3.0% to 3.3% and optimism from Fed head Yellen. Keep in mind, however, that the core PCE price index due today could remind traders of weaker inflation expectations.

Great review, guys. It is quite clear that Bitcoin has become an asset that has come to stay and that still has room to grow. However, we must pay attention to the altcoins, which often propose better solutions to problems that Bitcoin faces. One is DeepOnion, which was recently created but is becoming a more important anonymous currency with each passing day. With very fast transactions and very small fees, it has the power to tackle already established projects, such as Monero.

Hi, could you explain how $ price is affecting bitcoin price. For example: fed want to raise interest rate. In theory, it should increase the $ price vs other currency like Euro. But what would be the consequence for Bitcoin vs dollar ?