Bitcoin Price Key Highlights

- Bitcoin price is once again testing its all-time highs and could be due for more upside.

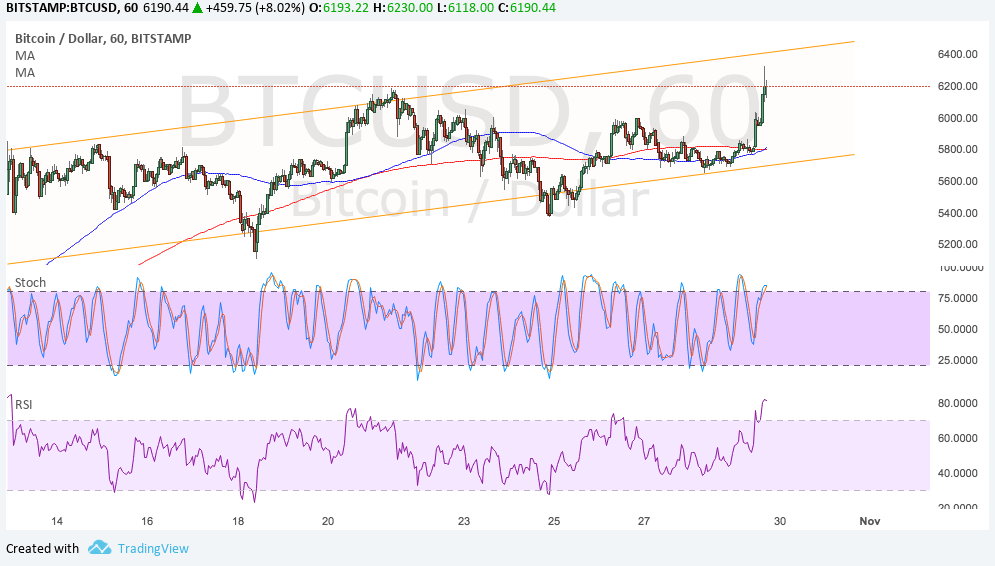

- Price is moving inside an ascending channel formation visible on its 1-hour and 4-hour charts.

- Bitcoin just bounced off the channel support and appears to be aiming for the channel resistance at $6400.

Bitcoin price seems to have enough upside momentum for a test of the channel resistance at $6400 to create new highs.

Technical Indicators Signals

The 100 SMA seems ready to cross back above the longer-term 200 SMA to signal a pickup in buying pressure. In that case, bulls could be strong enough to sustain a climb in bitcoin price back up to the channel resistance and beyond. The moving averages are close to the channel support at $5800 to add to its strength as a floor in the event of another pullback.

Stochastic is also on the move up to show that there is some buying pressure left. However, this oscillator is nearing overbought levels to indicate rally exhaustion. Similarly, RSI is already in the overbought area to show that profit-taking among bulls is possible.

Market Factors

Bitcoin price made a strong push at the end of the week as traders are turning their attention to the looming network upgrade. Bitcoin gold has launched and network acceptance is still pretty low, assuring investors that this rival version could wind up suffering a similar fate to bitcoin cash.

Besides, the FOMC statement for November is scheduled for this week so dollar traders must have booked profits in the previous week as well in order to reduce exposure to the top-tier event. Any indication that policymakers are still undecided on hiking in December could mean massive dollar losses.

Keep in mind that a number of FOMC members have expressed doubts on inflation, citing that weakness has been more persistent than initially expected. There will be no press conference in this particular Fed announcement so traders will need to read between the lines.