Bitcoin Price Key Highlights

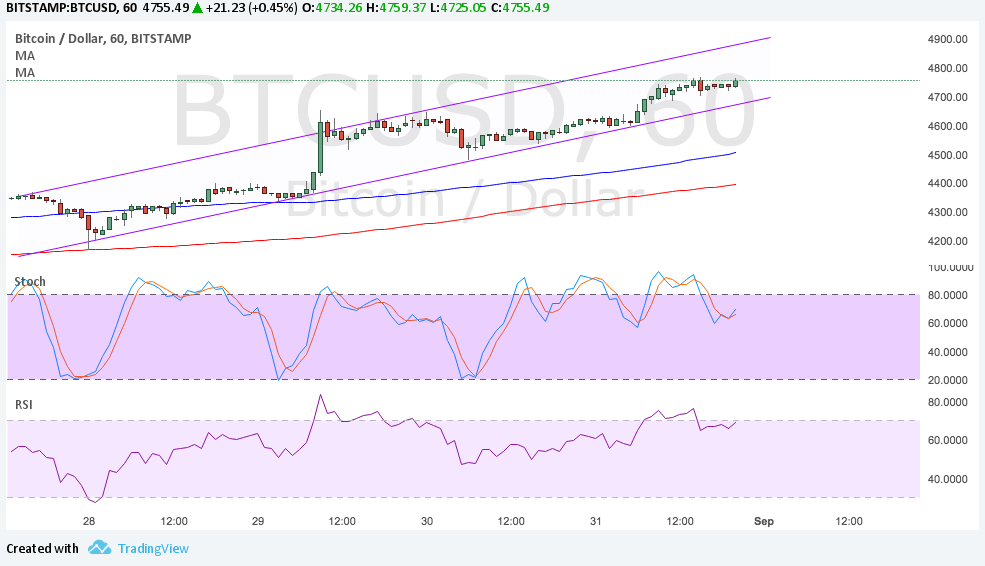

- Bitcoin price continues to make progress in this climb, aiming for the top of the steeper channel on the 1-hour chart.

- Bitcoin is able to benefit from the volatility in other financial markets due to geopolitical risk and profit-taking.

- Technical indicators are showing signs of weakening bullish momentum.

Bitcoin price is safely inside its ascending channel pattern visible on the 1-hour time frame, but there are signs of slowing upside momentum.

Technical Indicators Signals

The 100 SMA is still above the longer-term 200 SMA so the path of least resistance is to the upside. However, the gap is narrowing to indicate a slowdown in the rally. A break below the channel support could lead to a pullback to the moving averages’ dynamic support levels at $4500 and $4400, which are also around the bottom of a longer-term channel.

Stochastic is on its way down from the overbought zone so sellers are in control of bitcoin price action for now. RSI has just turned from the overbought area as well so a pickup in selling pressure might be due.

If bulls stay in control, though, bitcoin price could make its way to the top of the channel at $4900 or all the way up to the $5000 handle.

Market Factors

Changing market sentiment for the dollar and month-end profit-taking has drawn investors towards bitcoin instead, especially since there are geopolitical risks in play. Although risks of a missile strike from North Korea appear to have faded, the focus is now on the goings-on inside Washington.

In particular, Treasury Secretary Mnuchin started talking tax reform and adjusting the debt ceiling deadline earlier in order to get funds for Hurricane Harvey relief efforts. He also talked down the dollar in saying that, while the gains are understandable due to stronger economic performance and confidence in the currency, a weaker dollar would be more desirable.

The spotlight is now on the US NFP report as a strong read could renew Fed rate hike hopes while a downbeat figure could mean more dollar weakness versus bitcoin.