Bitcoin Price Key Highlights

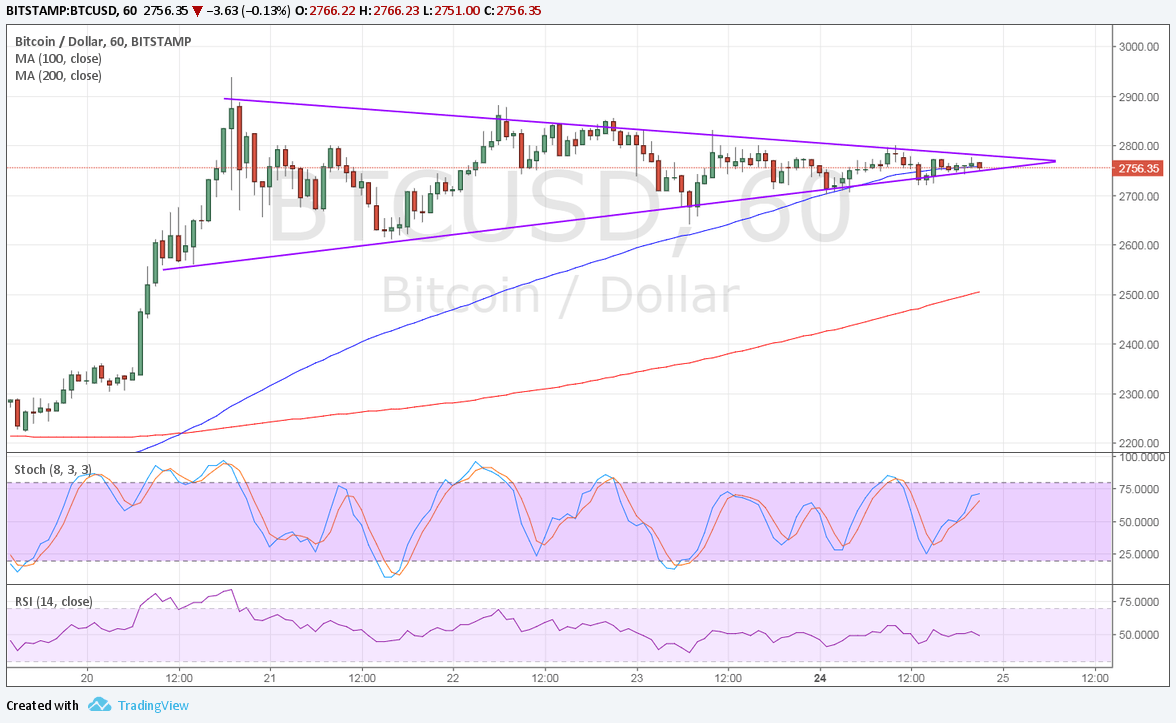

- Bitcoin price is still stuck in its symmetrical triangle pattern just below its all-time highs.

- A downside break could inspire a larger correction from the rally while an upside break could lead to the creation of new record highs.

- Technical indicators are mostly signaling that further gains are in the cards.

Bitcoin price could be due for an upside break from this short-term consolidation pattern, which looks like a bullish flag on long-term time frames.

Technical Indicators Signals

The 100 SMA is above the longer-term 200 SMA to signal that the path of least resistance is to the upside. Also, the gap between the moving averages is getting wider to indicate that bullish momentum is getting stronger. The 100 SMA is holding as dynamic support at the bottom of the triangle as well.

A break below support around $2750 could lead to a dip to the 200 SMA at $2500. On the other hand, a move past the $2800 mark could lead to another rally of the same size as the flag’s mast. This spans $2200 to $2800, so bitcoin price could be eyeing upside to the $3500 level.

Stochastic is moving up so bitcoin price might follow suit, but RSI is treading sideways to signal that further consolidation is possible. However, if stochastic reaches overbought conditions and turns lower, sellers could return.

Market Factors

Bitcoin price was lifted back up to its record highs when BIP 91 was locked in last week since this represents a step towards the upgrade to SegWit2x. This eased concerns about hard fork issues, reviving demand for the cryptocurrency.

However, BTCUSD is also being pulled by dollar demand as the FOMC statement is coming up. Weak CPI and retail sales might be enough for the Fed to backpedal on its hawkish stance but there’s also a good chance that policymakers would brush these off as temporary factors.

In that case, the US dollar could rally against bitcoin price if the US central bank reiterates its plans to unwind the balance sheet and also hike interest rates one more before the end of the year.