Bitcoin Price Key Highlights

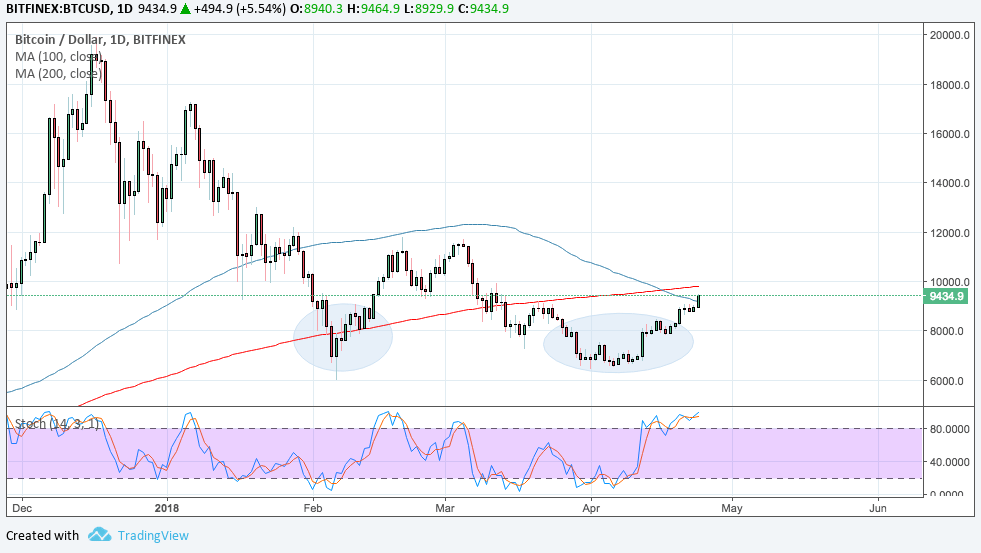

- Bitcoin price is forming a double bottom pattern on its daily time frame to signal that a climb is underway.

- Price has yet to test the neckline at $12,000 to confirm the longer-term rally.

- The chart pattern spans $6,000 to $12,000 so the resulting climb could be of the same size.

Bitcoin price has failed in its last two attempts to break below the $6,000 level to create a double bottom reversal formation.

Technical Indicators Signals

The 100 SMA has crossed below the longer-term 200 SMA to signal that the path of least resistance is to the downside. This suggests that the downtrend could still resume from here, especially as price tests the inflection points at the moving averages.

This also lines up with an area of interest at the $10,000 major psychological level. If selling resumes, bitcoin price could fall back to the lows around $6,500. On the other hand, a move past the neckline could lead to a climb to $18,000 or even the record highs at $20,000.

Stochastic is already indicating overbought conditions to show that buyers are already exhausted and could let sellers take over.

Market Factors

Sentiment in the industry continues to improve as traders are paying closer attention to developments, such as acquisitions and the pickup in volumes. Altcoins are seeing listings on more exchanges and hard forks have been completed without any major issues so far.

Then again, the dollar is somewhat supported by improving medium-tier data and rising US bond yields. Risk aversion could peek back in as geopolitical risks have been revived by Trump’s comments on the Iran deal.

Bitcoin price appears to be shrugging off negative reports, particularly comments from founding PayPal CEO Bill Harris who said that bitcoin is a “colossal pump-and-dump scheme, the likes of which the world has never seen.”

Furthermore he went on to say:

The losers are ill-informed buyers caught up in the spiral of greed. The result is a massive transfer of wealth from ordinary families to internet promoters. And “massive” is a massive understatement — 1,500 different cryptocurrencies now register over $300 billion of “value.”

It helps to understand that a bitcoin has no value at all.

It also helps to understand that neither does the dollar have any value beyond that of the piece of paper it’s printed on, unless there’s somebody else who believes it has and is willing to trade you something for it.

Actually, a dollar has a global superpower backing it…Bitcoin does not

And if the people decide it’s worthless, what a government says matters hardly at all. You can see this play out as far back as the Roman Empire, and probably back far further still.

Bitcoin has blockchain technology backing it, the dollar does not. The value of everything is subjective. Bitcoin is worth zero to some people and it is also worth a lot to some other people.