Bitcoin Price Key Highlights

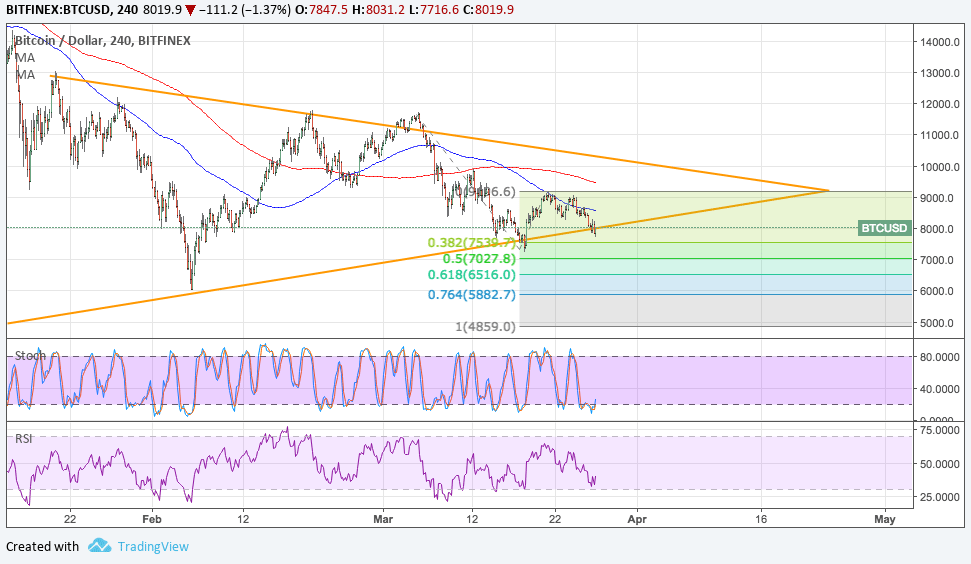

- Bitcoin price is back to testing the symmetrical triangle bottom on its 4-hour time frame.

- Increased selling pressure could take it below support and on a continuous selloff.

- The Fibonacci extension levels show the nearby support areas where sellers could book some profits.

Bitcoin price is back in selloff mode as it tests the triangle support to determine whether further consolidation or a downtrend is underway.

Technical Indicators Signals

The 100 SMA is below the longer-term 200 SMA to signal that the path of least resistance is to the downside. This means that support is more likely to break than to hold. The short-term moving average also recently held as dynamic resistance as well.

Bitcoin price looks ready to test the 38.2% extension at the swing low around $7540 or the 50% extension at $7027. Stronger selling pressure could take it down to the 61.8% extension at $6516 or the 76.4% level at $5882. The full extension is located at $4859.

Stochastic is indicating oversold conditions and is starting to turn higher, though, so there’s still a chance that bullish pressure could return. RSI has some room to fall before hitting oversold levels so there may be some selling momentum left.

Note that the triangle spans $6,000 to $13,000 so the resulting downtrend could be of the same height. If support holds, a bounce back up to the resistance around $10,000 could be seen.

Market Factors

Twitter also announced that it would ban cryptocurrency ads on its platform, following in the footsteps of Facebook and Google. This could dampen investor interest and volumes, which led several traders to liquidate positions in anticipation of low volatility.

Prior this, the mood in the industry has already been pretty somber since Japan has announced plans to shut down Binance in the country and South Korea echoed the same sentiments. Combined, this would mean lower volumes worldwide as both countries account for majority of bitcoin transactions.

So, this author seriously needs to do better reporting and stop being a part of the problem by spreading FUD in the mainstream media. Nowhere was it ever said that Japan would be shutting down Binance. They were issued a warning, and so Binance will be moving to Malta. Why doesn’t she report that good news? Malta’s a pro Blockchain country and so Binance will be able to operate fine. Also, South Korea’s becoming more lax over crypto. If you do a very simple Google search with the terms Bitcoin South Korea, there are several positive articles about SK’s greater acceptance of this space. Journalists like those who wrote this article and throughout the industry need to stop writing such sensationalistic articles it’s ridiculous. I mean you’re all turning into Fox News with your manipulative agendas so seriously, cut it the fuck out.

So Let’s not talk about the real problems! lets hide it! Al is fine! Malta is a fine place place to be but it’s not JAPAN! It´s a downgrade! And soon EU will crackdown on Cripto too! and then what! South America! Maybe Venezuela! Be real!

You are clueless if you think the price of Bitcoin is driven by news. If you are an investor, realize you won´t see 20k for a long long time. If you are a trader,…traders profit form both bull and bear markets.

What are you talking about? So the herd isn’t influenced by news, especially at a time when regulation is causing people to panic, and Google, Facebook, and Twitter are banning crypto ads? Everyone’s on edge. The price isn’t influenced exclusively by FUD, but it sure hasn’t helped. I don’t think it’s a coincidence at all that in February you had one bad news line after another that basically drove the market to a capitulation price of 6k, then mysteriously the articles stopped for a time to allow the price to rise. Same thing’s happening again. Manipulation of the herd at its finest. On the other hand, of course in unregulated markets you have manipulation by whales, but that’s not the only piece of the price puzzle.

I think it’s an ascending triangle or simply a bear flag. In he upside you don’t have a trend (you are violating the Mar-5 high). You have an horizontal resistance in $11700. It should hit and bounce in $7500 but still with low volume so it will not give us a consistent bottom.