Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

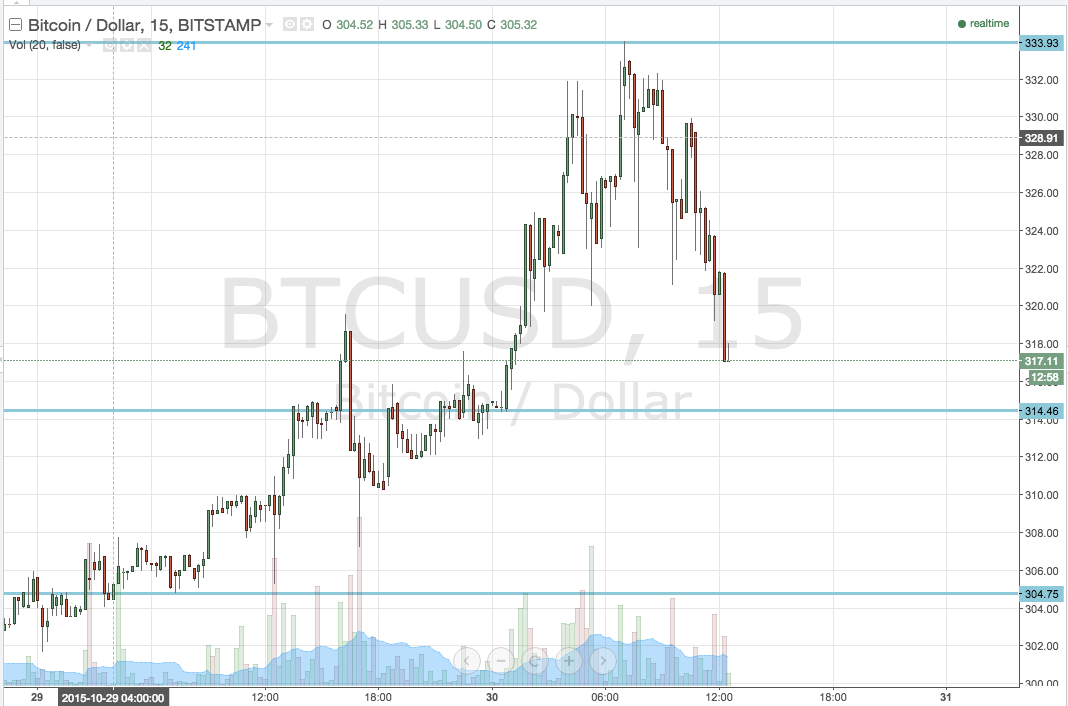

There sees to be no limit to the upside potential we are seeing in the bitcoin price at the moment. Fundamentally, there have been no real developments (nothing that differs from the usual bitcoin news updates, at least) and so the momentum we are seeing looks t be purely sentiment driven. People are finally coming around to the idea that bitcoin can serve as a risk off asset and, as a result, the bitcoin price is picking up pace. The action we have seen as late has made for an interesting few weeks for our intraday strategy, with the primary focus having been to the upside through incorporation of our breakout approach. This remains so today, and with this said, what are the levels we are looking at during today’s European session, and where are we looking to get in and out of the markets on any volatility? Take a quick look at the chart to get an idea of what we are watching.

As the chart shows, the bitcoin price continued to gain strength overnight, but is currently undergoing what I deem a medium term correction from highs at 334. This latter level serves as in term resistance for today’s session, while 314.46 serves as in term support.

This is a much wider range than normal, so we can bring our intrarange into play if we reach in term support. A long entry on a bounce from 314.4 with a stop just the other side of our entry and a mid range target of 320 flat is a nice take.

Looking the other way, a break above in term resistance at 334 would put us long towards a medium term target of 340 flat, with a stop somewhere around 330 keeping things attractive from a risk management perspective.

Charts courtesy of Trading View