Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

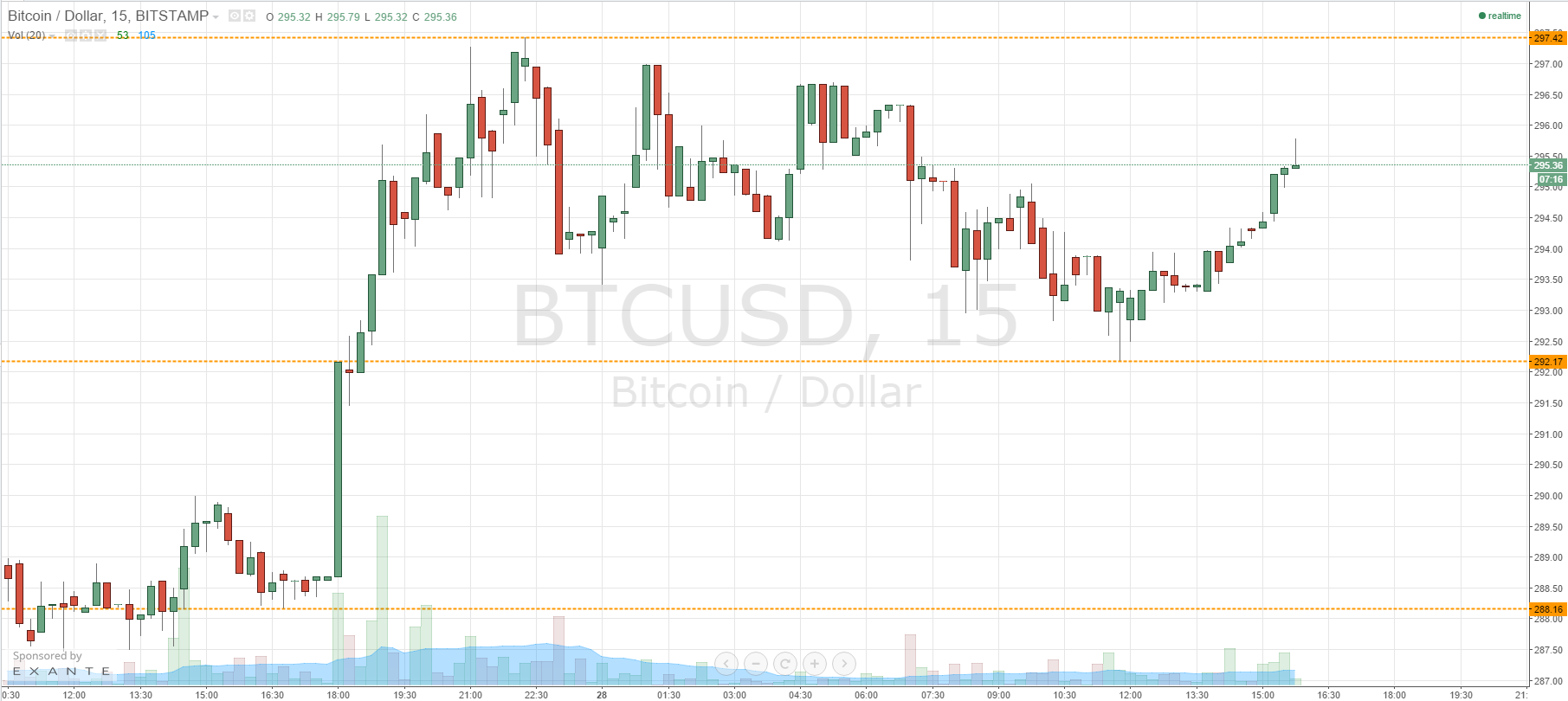

Earlier this morning we published our pre-session bitcoin price watch piece. We suggested the levels to watch in the bitcoin price throughout today’s European session, and pointed out that we had finally seen some action in the bitcoin market over the weekend, and that we would be looking to draw on this volatility to get in and out of the markets today. Action has now matured, and as we head into the Asian session this evening – what are the levels that we are watching tonight, and are we looking at a range bound, or breakout strategy going forward? Let’s take a look. First, consider the chart below.

As you can see, we are currently trading mid-range between very similar levels that we highlighted this morning. In term support sits at 292.17, and this is what we will be looking at to the downside, while in term resistance lies at 297.42 – the level to watch from an upside perspective.

We will initially look for a break above in term resistance (in line with the overarching bullish directional action we have seen over the last few days) to validate a medium term upside bias. On this trade, a stop loss somewhere around 296 flat and a target at 300 will make the trade attractive from a risk management perspective.

Looking the other way, if we get a reversal of the longer term trend and we see a break below 292.17 (in term support), it will put us short (on a close below this level) towards a medium term downside target of 288 flat – last week’s lows. Again, just as with the upside bias, on this trade we will look to keep a positive risk management ratio, so a stop loss somewhere around 293.5 looks good.

Charts courtesy of Trading View

What’s in the cards is an impending otc hotstock style dump nothing else.