Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

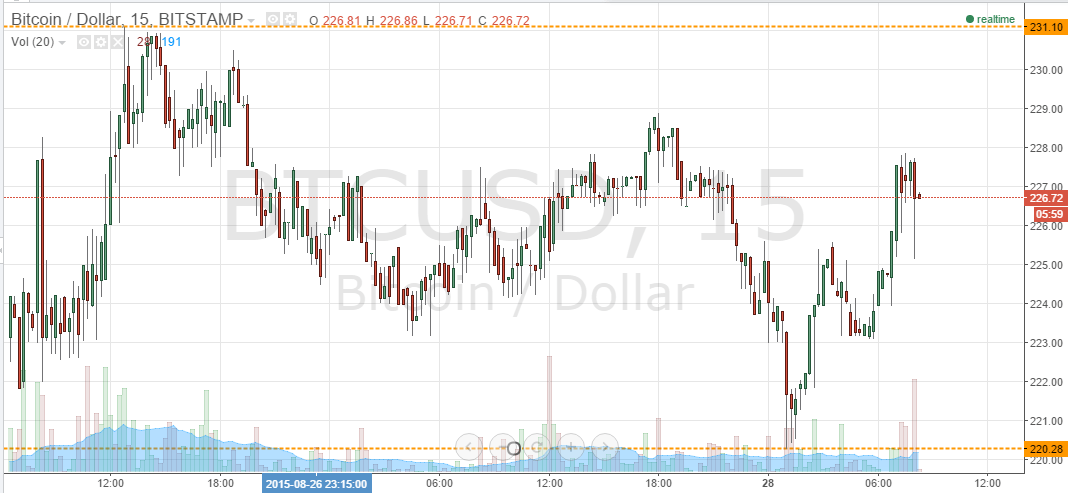

In these bitcoin price watch pieces, it’s not uncommon for us to trade a relatively tight range. Over the last week or so, however, we had quite a lot of volatility in the bitcoin price, and it has afforded us the opportunity to widen out our parameters a little bit and try out some intra-range trading. We did this overnight in the Asian session on Thursday, and as we head into a fresh European session today, let’s try something similar. So, with this said, what are the levels that we are going to keep an eye on today, and how we going to look to trade bitcoin price as we head into the weekend? Take a quick look at the chart.

As you can see, we are currently trading around 226.72. This is mid-range between what serves as in term support at 220.28, and in term resistance at 231.10. As we head into today’s session, these are the two levels were going to watch. So initially, we will look to trade from in term resistance on a short entry, with a medium-term downside target of 220.28. On this trade, a stop loss somewhere around 232 believe is plenty of room for a error in the event that we spike up and the range, while also offering operative reward on the trade to the downside.

Looking the other way, if we reach 220.28, we will look for a bounce from this level to validate a long entry towards 231.10. Once again, a stop loss is necessary on this one as there is every chance that we could spike beyond yesterday’s lows. With this said, we don’t want to leave too much room as a stop loss is there to help us not take too substantial a loss. So, with this said, somewhere around 217 flat gives us about a 3 to 1 risk reward profile.

Charts courtesy of Trading View