Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

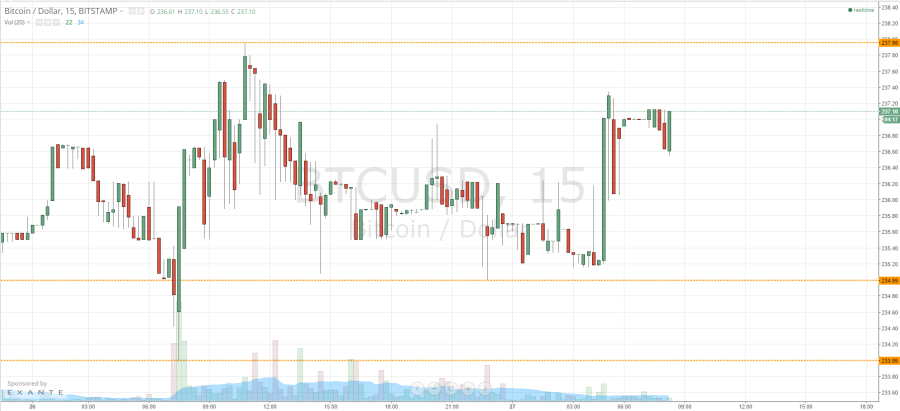

Yesterday evening, we published our twice-daily bitcoin price watch piece. In the piece, we highlighted the levels were watching throughout Tuesday evening, and suggested how we would respond to these levels as far as entering according to our scalp strategy was concerned. Now action has matured overnight, and we have seen quite a bit of volatility on an intraday basis. With this said, what are the levels we are keeping an eye on at the moment in the bitcoin price, and how can we get into the markets during today’s session if we get a continuation of the volatility? Take a quick look at the chart.

As you see, action overnight has been up and down, but we have broadly remained within our predefined range of in term support at 234.99 and resistance at 237.96. These are the two levels that we will be keeping an eye on as we head into today’s session.

We are currently trading mid-range, so we will look for a run up towards 237.96 – and a close above this level on an intraday basis – to validate an initial upside target of 241 flat. This gives us about 3 ½ dollars worth of reward, so a stop loss somewhere around 236.6 will maintain a positive risk reward profile while ensuring we do not find ourselves on the end of a severe loss in the event of a bias reversal.

Looking the other way, if price runs down towards in term support, we will look for a close below this level to signal a short entry. 230 flat has played a key role over the last couple of weeks, and – as such – offers us a nice firm downside target for today. On this trade, a stop loss around 236 flat keeps our potential downside target while leaving just enough room to avoid a chop out.

Charts Courtesy of Trading View