Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

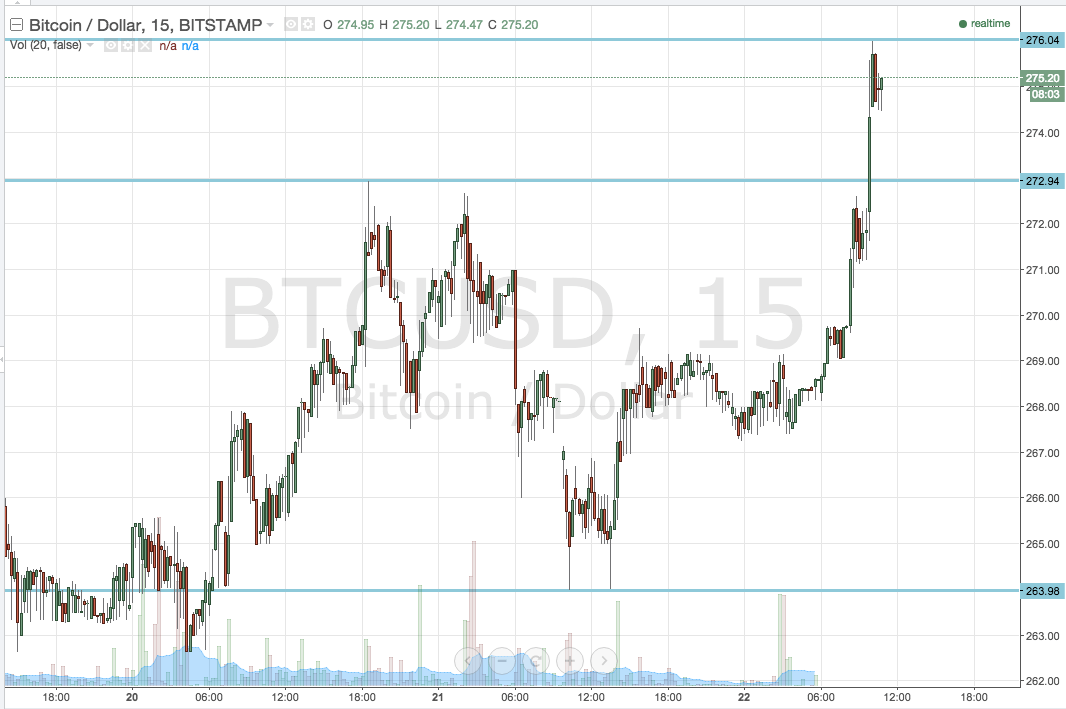

So for the past day or so we have been experimenting with a wider than normal range in the bitcoin price, with the goal of bringing our intra range strategy into play. Last night we got some pretty solid upside momentum, and saw this intra range play validated with a profit hit on our long trade during the Asian session. Action has now consolidated somewhat, and for today’s session we are looking at bringing our breakout strategy back into play. As such, we are tightening up our range, and looking at some predefined key levels to give us our entry and exit points. Here’s what we are looking at, alongside where we are looking to place our risk management parameters. Take a quick look at the chart.

As you can see, todays range is defined by in term support at 272.94 and in term resistance at 276.04. With about $4 worth of wriggle room, it’s a little tight to adopt anything intra range, so we will be solely focused on playing the key levels as we break to the up or downside respectively.

If we get a break through in term resistance, and a close above this level, it would suggest a longer term continuation of the action seen overnight, and put us long towards a medium term upside target of 280 flat. These would be medium term highs in the bitcoin price, so expect some level of friction as we head higher – a stop loss just the other side of our entry (somewhere around 275 flat) would ensure we are taken out of the trade in the event of a bias reversal and us returning to trade within range.

Looking the other way, a break below in term support at 272.94 would put us in a short trade towards a longer term downside target of 263.98.

Charts courtesy of Trading View