Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

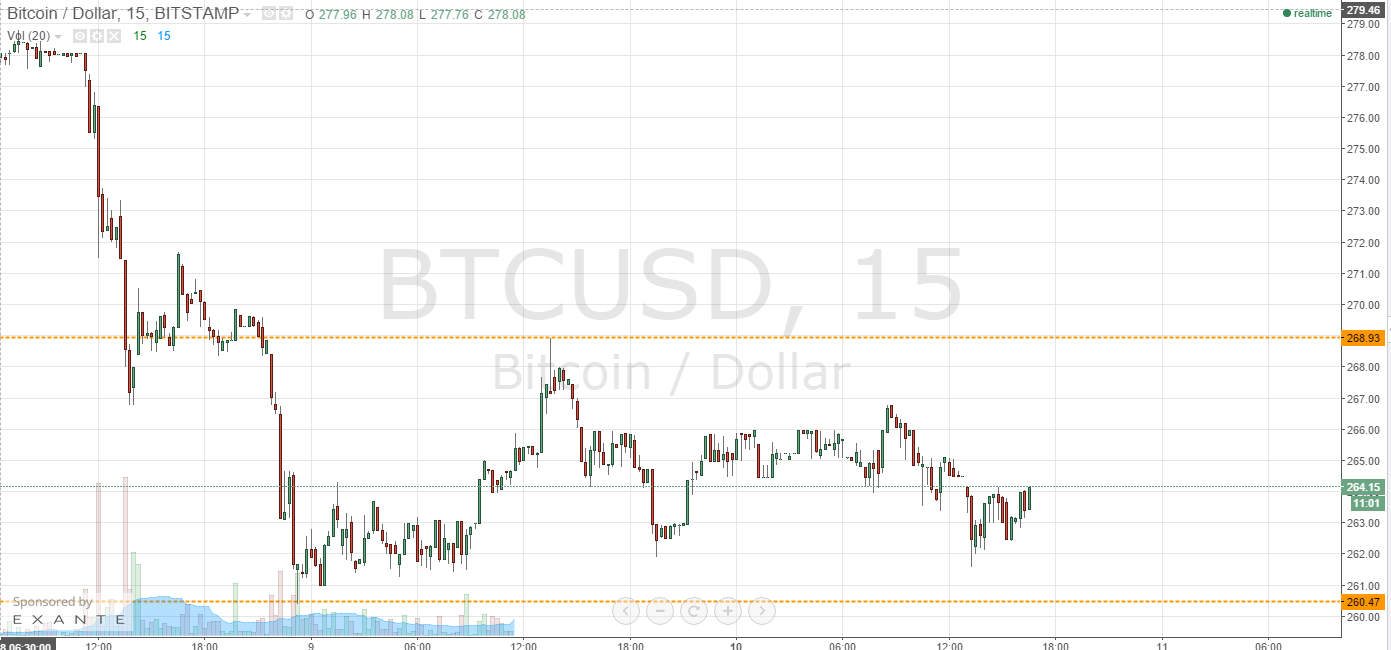

In this morning’s twice-daily bitcoin price watch piece, we suggested the levels that we would be watching throughout the afternoon, and pointed out that – if we didn’t get much volatility, we could implement an intra-range strategy in place of our standard intraday trading. Action has now matured throughout Monday’s European session, and as we head into a fresh Asian session, did we manage to get in and out of the markets today, and if not, where will we look to trade this evening? Take a quick look at the chart.

As you can see, today’s bitcoin price action was relatively mute. We are currently trading between the levels that we had slated this morning as our definable parameters, with in term support at 260.47 and resistance at 268.93. Once again, these are going to be the levels that we keep an eye on as we head into tonight’s session. There are four potential trades on this evening.

The first is if we break below 260.47, we will look to enter short towards 255 flat, with a stop loss somewhere around 262 keeping things tight from a risk management perspective.

The second is if we bounce from 260.47, we will look to enter long on our intra-range strategy towards in term resistance at 268.93.

A break above 268.93 would put us long towards 271 flat, whilst a correction from this level would bring in term support into play on a short trade from 268.93, with a stop loss somewhere around 270 flat keeping things attractive on the risk management side of things.

Bear in mind that today’s bitcoin price action has been relatively tight, especially when compared to the steep decline we saw over the weekend, so make sure to employ equally tight money management techniques in order to avoid getting on the wrong end of a change in direction and an unsustainable loss from a capital perspective.

Charts courtesy of Trading View