Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

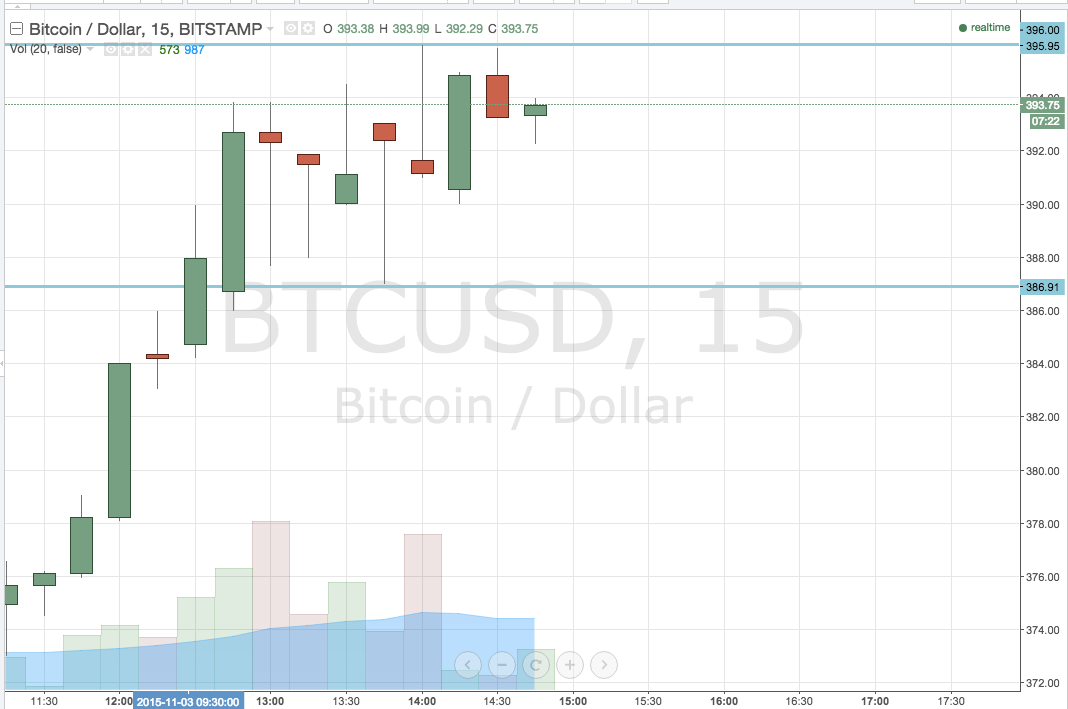

So this morning we outlined our breakout strategy that we would be implementing during today’s European session, with the key inference being that we would look for a return to the overarching bullish momentum and try and play an upside break on a medium term bullish target. Action has now matured throughout the day, and as we head into tonight’s Asian session and beyond, how did we fare on our strategy, did we manage to get in and out of the markets according to our predefined key levels, and what are we looking at tonight? Further, what are our medium term expectations for the bitcoin price as we approach the psychologically significant $400 flat? As always, take a quick look at the chart to get an idea of the levels we are keeping an eye on.

As the chart shows, we have shifted in term resistance to what turned out as intraday highs of 396 flat, and maintained support at 386.91. These are going to be our range defining parameters for this evening. As a quick side note, we did get into a long trade on a breakout of today’s resistance, and took out our target a little earlier this afternoon. We are now free to trade the altered key levels without being restricted by an open trade.

So, with this said, we are going to look for a breakout above in term resistance to validate a medium term long entry to what might prove an elusive target at $400. This is quite a tight trade, pretty much an upside scalp, but the level will probably serve up too strong a resistance (at least near term) for us to be able to justify a target beyond. As usual we will need to bring a stop loss into play to protect our downside. We are looking at current levels, somewhere around 394, as a nice risk defining area. Not only will this ensure we are taken out of the trade in the event of a bias reversal and a shorter term correction, it will also keep our risk reward profile positive by a factor of around two to one.

Charts courtesy of Trading View