Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

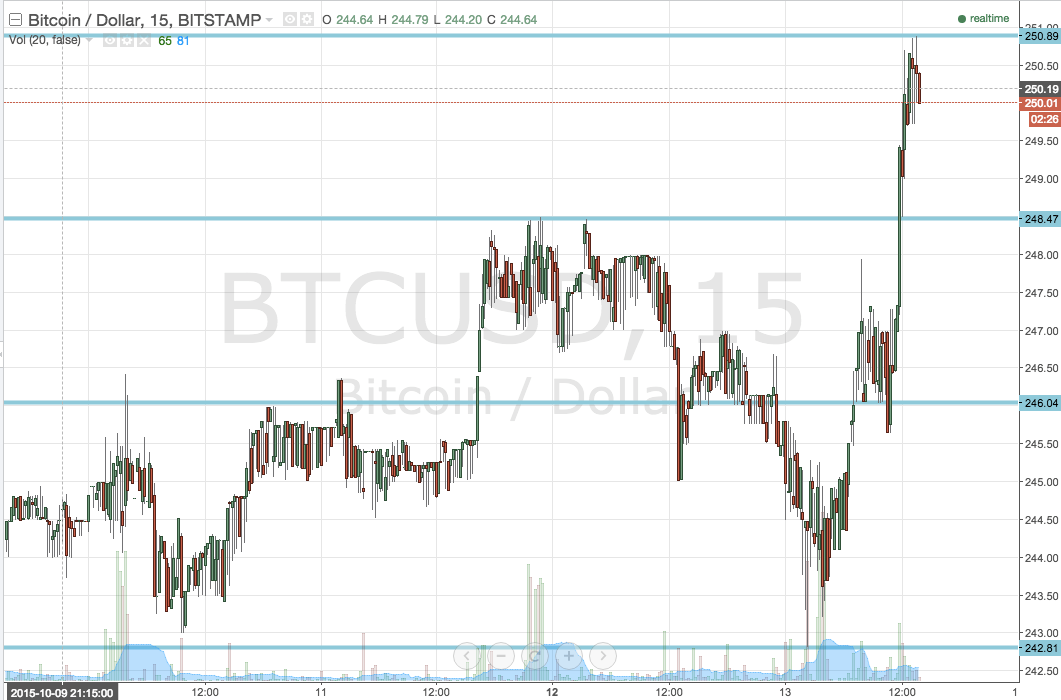

Earlier this morning, we published our twice daily bitcoin price watch piece. In the article we suggested the levels that we were looking to keep an eye on in the bitcoin price during today’s European session, and further, how we would use these levels to get in and out of the market according to our intraday strategy. The European session will soon draw to a close and, as we head into this evening’s Asian session, let’s take a look at how our strategy fared today, and where we will be looking to get in and out of the markets going forward. First up, take a quick look at the chart below.

As you can see, today’s action saw an upside break of the level we slated as in term resistance this morning, and post-break, a continuation of the upside momentum. The levels we are looking at this evening are this morning’s broken resistance at 248.47 (now offering up in term support) and today’s highs and the latest swing reversal at 250.89.

If we can break above in term resistance, it will put us in a secondary long trade towards an initial upside target of 255 flat. A top on this one somewhere around 249.5 will make sure we don’t get on the wrong end of the market in the event of a turnaround and reversal in the market’s directional bias.

Looking the other way, if we end up giving back some of today’s gains, we will look for a close below in term support at 248.87 to validate a short term downside trade towards this morning’s in term support at 246.04. This is a scalp trade, so a tight stop is required – somewhere around 249.5 should do the trick.

Charts courtesy of Trading View