Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

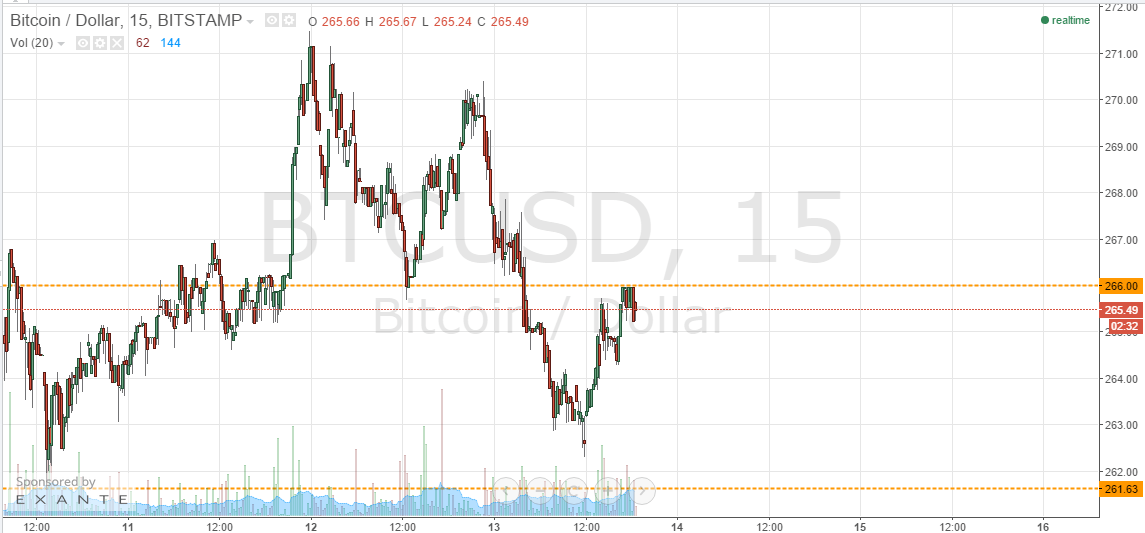

Early this morning we discussed the action we had seen in the bitcoin price during Wednesday night’s Asian session, and highlighted the levels that we would be keeping an eye on during Thursday’s European session. We pointed out that action had been tight over the past few days, and that as a result, will be looking to implement a combination of both our intraday breakout strategy and – if the opportunity arose – a scalp strategy based on our predefined range. As it happened, neither of these strategies proved effective during today’s session. Action remained well within the range we slated as what to watch this morning, and – despite a small amount of volatility this afternoon – we end the day pretty much where we began. So, with this said, what are the levels that we are watching this evening, and where will we train into the markets in the event that we do see some volatility on any fundamental driven markets? Take a quick look at the chart.

As you see, we have not really moved our predefined range since we highlighted this morning. As a result, in term support remains at 261.59, while resistance now sits at 266.11. As usual, these are the two levels that we will be watching during tonight’s Asian session. We’re currently mid-range, and we will look for a break above 266.11 to validate an interim and medium-term upside target of 271.47. On this trade, a stop loss somewhere around current levels will help to maintain a positive risk reward profile on the trade.

Looking the other way, a break below 261.59 would put us short towards a medium-term downside target of 255 flat. We have a little more room on this trade, so a stop loss somewhere around 264 is valid and leaves us enough room to avoid being chopped out in the event that we return to trade within range in the short term.

Charts courtesy of Trading View