Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

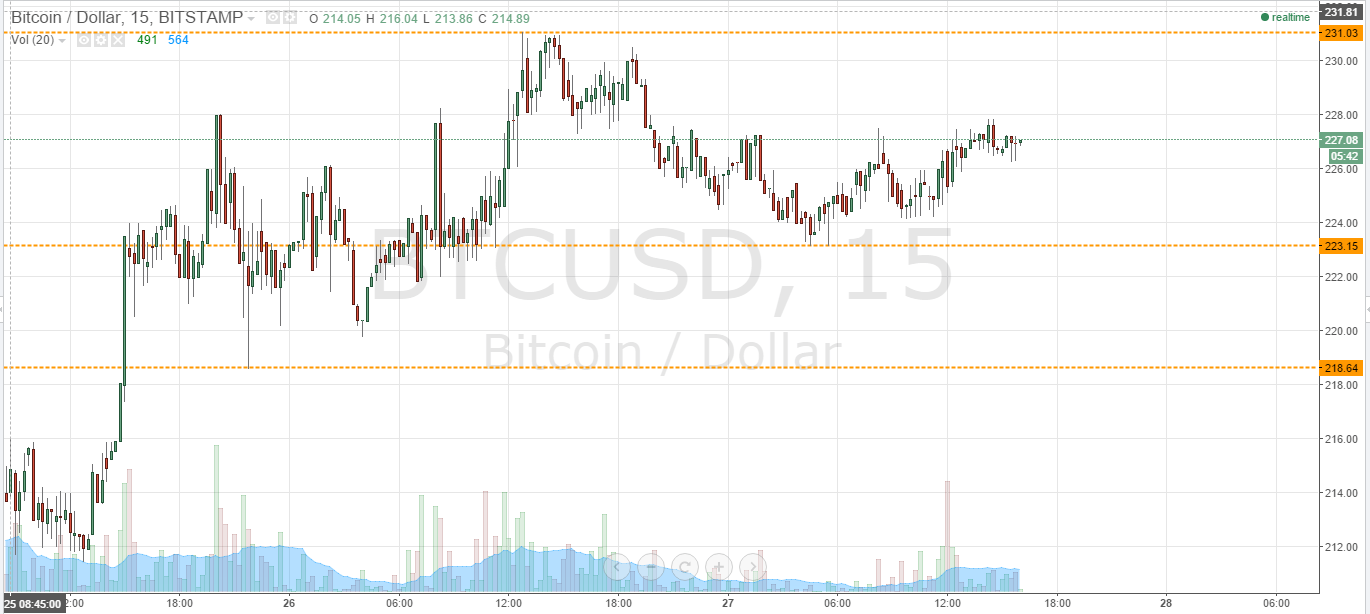

In this morning’s bitcoin price watch piece, we highlighted the levels that we would be watching throughout today’s European session. We suggested that – on the back of the volatility we have seen throughout the majority of this week – we may get some further volatility from which we could draw medium-term profits. As action has matured throughout today, it has become apparent that we will likely not see this volatility before the Asian session kicks off tonight. However, before this happens, it’s worth highlighting the levels that we are watching this evening, and addressing where will be looking to get in and out of the markets according to our intraday strategy. So, take a look at the chart.

As you see, throughout today’s session we ranged between the levels that we defined as our intraday parameters this morning. With this said, in term support remains at 223.15, while resistance remains at 231.03. These are the two levels that will be keeping an eye on during this evening session.

To kick off, we could play an intra-range strategy. This will involve going long at support (223.15, with a stop loss around 222 flat and a target of 231.03. Conversely, we will look to enter short at resistance at 231.03 with a stop loss around 233 flat, and a downside target of 223.15.

Looking at things from a breakout perspective, if we get a break below 223.15 will put us short towards 218.64. Looking the other way, a run and a close above 231.03 will get us into a long trade with target of 235 flat on a stop loss around 230.

Charts courtesy of Trading View